Bitwise Asset Management has introduced an actively managed exchange-traded fund designed to mitigate the effects of currency debasement by combining Bitcoin (BTC), precious metals and mining equities.

On Thursday, the firm launched the Bitwise Proficio Currency Debasement ETF on the New York Stock Exchange under the ticker BPRO. The fund allows discretionary allocations across digital assets and commodity-linked securities, aiming to provide exposure to assets commonly used as stores of value while addressing concerns over persistent inflation.

BPRO maintains a minimum allocation of 25% to gold and has an expense ratio of 0.96%. The strategy emphasizes capital preservation rather than maximizing upside, reflecting a broader shift in institutional positioning toward using crypto within macro and defensive portfolios.

Bob Haber, chief investment officer at Proficio Capital Partners, said gold remains underrepresented in modern portfolios, citing Goldman Sachs research indicating that gold ETFs comprise only a fraction of 1% of private financial holdings.

Debasement theme shapes crypto narratives and allocation strategies

Fiat currency debasement — the gradual decline in purchasing power — has been a core theme within the Bitcoin community.

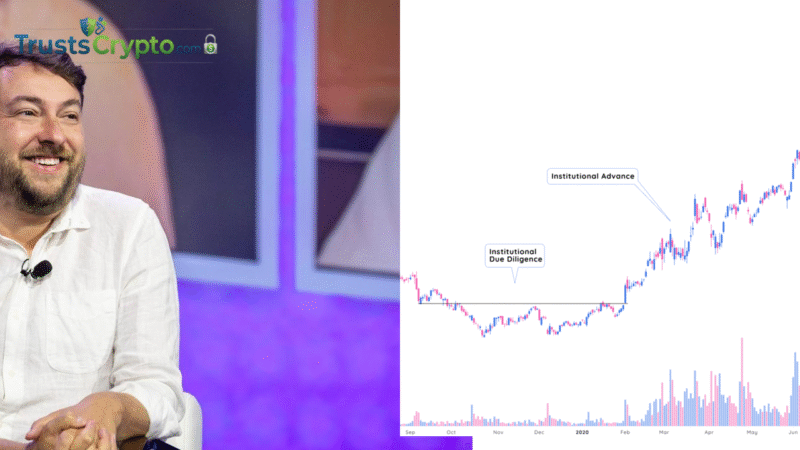

Bitcoin has often been promoted as a long-term hedge against debasement due to its fixed supply and historical performance. However, Bitcoin has recently trailed gold, prompting questions about its effectiveness as a hedge in the current macroeconomic environment.

In a recent analysis, Karel Mercx of Dutch advisory firm Beleggers Belangen argued that Bitcoin has not consistently delivered as a reliable hedge against currency debasement. Mercx pointed to a period when Bitcoin underperformed even as U.S. President Donald Trump publicly challenged the Federal Reserve’s independence — a scenario that can raise concerns about monetary credibility and long-term inflation. While gold reacted to those signals, Bitcoin did not, weakening its case as a near-term hedge against debasement.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.