Bitwise CIO: Crypto Index Funds to Grow as Complexity Grows

Broad cryptocurrency index funds are expected to gain traction in 2026 as investors seek streamlined exposure to an increasingly complex market, according to Bitwise Chief Investment Officer Matt Hougan. In a note published Monday, Hougan said the asset class is expanding with more use cases, making diversified tracking products more appealing.

Hougan added that while the overall crypto market is likely to grow, it remains difficult to identify which individual tokens will outperform. He said market-tracking funds can serve as a practical entry point for investors, though they may not be suitable for everyone. You can read more about Hougan’s insights on this topic here.

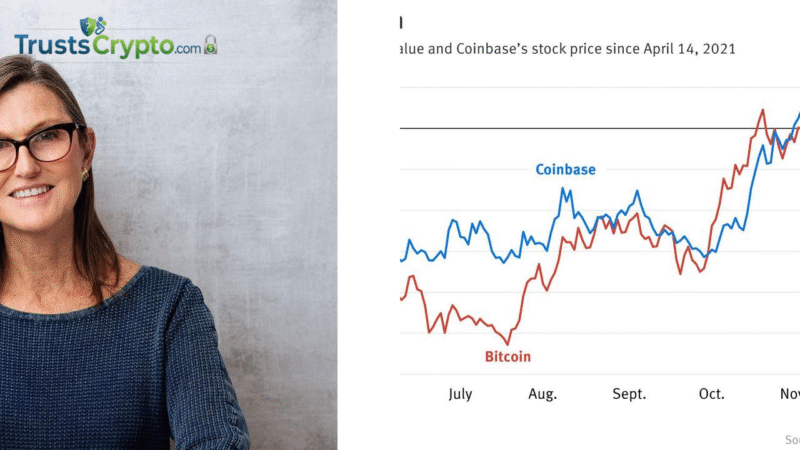

Multiple exchange-traded fund issuers, including Bitwise, offer products that track baskets of cryptocurrencies, drawing parallels to equity benchmarks such as the S&P 500. Multi-asset crypto ETFs launched in the United States earlier this year, with allocations generally weighted by market capitalization. Inflows have been modest to date, as these funds are heavily tilted toward Bitcoin (BTC), which accounts for nearly 60% of the market, according to CoinGecko.

“Buy the market” amid uncertainty in crypto

Hougan said that even with extensive industry experience and access to experts, he cannot confidently predict which blockchain will prevail or how the landscape will unfold. He noted outcomes will be influenced by regulation, execution, macroeconomic conditions, the decisions of key individuals, luck, and numerous other variables, adding that accurately forecasting all factors would require extraordinary foresight.

Crypto assets rallied from November 2024 through January around Donald Trump’s presidential election and inauguration and have remained elevated alongside pro-crypto policy signals. The sector has also encountered headwinds from broad U.S. tariffs and uncertainty over the trajectory of additional interest-rate cuts as traditional finance participation increases.

Given the uncertainty, Hougan said his approach is to “buy the market,” specifically through a market-cap-weighted crypto index fund.

He said crypto is likely to be significantly more important in 10 years and suggested the market could expand by as much as 20 times over that period. Hougan referenced comments on Wednesday by Securities and Exchange Commission chair Paul Atkins indicating the U.S. financial system could adopt tokenization within a “couple of years”. In a post on Dec. 8, 2025, Hougan noted the U.S. equity market is approximately ~$68 trillion, while tokenized stocks total around ~$670 million.

Hougan added that stablecoins, tokenization, and Bitcoin are poised to play larger roles, alongside additional use cases such as prediction markets, decentralized finance (DeFi), privacy technologies, and digital identity. He said he uses a crypto index fund as the core of his portfolio to maintain exposure to potential winners and avoid the risk of selecting the wrong chain, warning that even in a market that rises 100,000x, investors could still underperform if they back the wrong asset.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.