Crypto Today: Itaú Backs BTC, OCC OKs Trust Banks, Tokenization

Today’s crypto developments included a portfolio allocation call from Itaú Asset Management, analysis from NYDIG on tokenization’s near-term impact, and conditional national trust bank approvals from the U.S. Office of the Comptroller of the Currency.

Brazil’s largest private bank advises investors to allocate 3% to Bitcoin in 2026

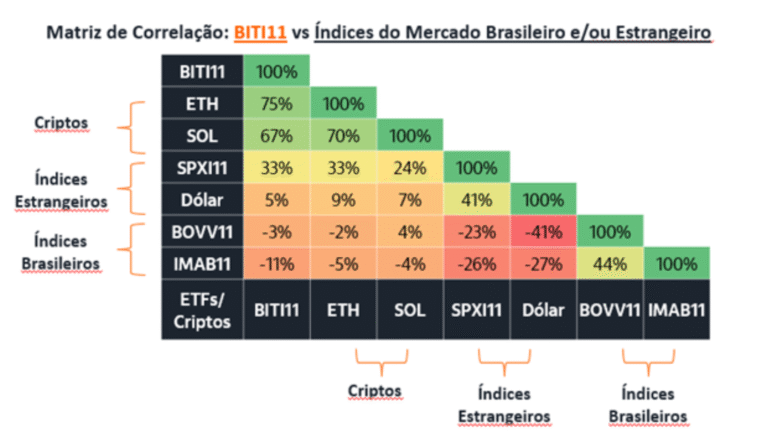

Itaú Asset Management, the investment unit of Itaú Unibanco, recommended that investors hold 1% to 3% of their portfolios in Bitcoin next year, according to a new research note.

Renato Eid of Itaú Asset said the current global environment, including geopolitical tensions, changes in monetary policy, and ongoing currency risks, supports adding Bitcoin (BTC) as a complementary asset.

He described Bitcoin as “an asset distinct from fixed income, traditional stocks, or domestic markets, with its own dynamics, return potential, and — due to its global and decentralized nature — a currency hedging function.”

The recommendation follows a volatile year for Bitcoin. The asset started 2025 near $95,000, dropped toward $80,000 during the tariff crisis, climbed to a record high of $125,000, and later stabilized around $95,000.

NYDIG: Early tokenization benefits will be limited but may expand

The initial advantages of tokenizing assets such as stocks will be modest and may not significantly benefit the crypto market at first, but they could grow as “interoperability and composability increase,” NYDIG global head of research Greg Cipolaro said on Friday.

He noted that early benefits will include transaction fee revenues and growing network effects for the hosting blockchains. Over time, more favorable regulations could broaden reach and make access “more democratized.”

Cipolaro added that building interoperable tokenized assets is complex because they “differ greatly” and operate across public and private blockchains. Most also still rely on traditional financial frameworks to remain compliant.

Tokenizing assets, including U.S. equities, has gained momentum this year as major exchanges explore tokenized stock platforms. Securities and Exchange Commission chair Paul Atkins has said the U.S. financial system could adopt tokenization within a “couple of years.”

Paxos, Ripple, Circle and others receive conditional U.S. trust bank approvals

The U.S. Office of the Comptroller of the Currency (OCC) has conditionally approved five national bank charter applications from digital asset firms.

In a Friday notice, the OCC said BitGo, Fidelity Digital Assets, and Paxos received conditional approval to convert their state-chartered trust companies into federally chartered national trust banks. The agency also conditionally approved new national trust bank applications from Circle and Ripple.

“New entrants into the federal banking sector are good for consumers, the banking industry and the economy,” said Jonathan Gould, the Comptroller of the Currency. “The OCC will continue to provide a path for both traditional and innovative approaches to financial services to ensure the federal banking system keeps pace with the evolution of finance and supports a modern economy.”

These five firms are among a broader group of crypto companies seeking OCC approvals to expand into banking services. In October, Coinbase said it had submitted an application but had “no intention of becoming a bank.”

Applicants indicated they would use the charters to offer digital asset custody services. While Paxos’ approval permits the bank to issue stablecoins, Ripple’s application stated it would “not be a stablecoin issuer” for its U.S. dollar-pegged coin, RLUSD (RLUSD).

“Paxos’ federally regulated platform will allow businesses to issue, custody, trade and settle digital assets with clarity and confidence,” the company said in a Friday statement.

Friday letter approving Circle’s national trust bank charter application. Source: OCC

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.