Memecoins’ Next Chapter: Tokenized Attention After 2025 Crash

Memecoins are expected to reemerge in a different format despite recent market weakness, according to Keith A. Grossman, president of payment infrastructure firm MoonPay. Grossman said the sector’s core innovation lies in blockchain’s ability to tokenize attention at low cost, broadening participation in the attention economy.

Grossman noted that, prior to crypto, monetization of attention largely benefited platforms, brands and a limited number of influencers, while broader community activity — such as likes, trends and in-jokes — created substantial value that typically did not return to participants.

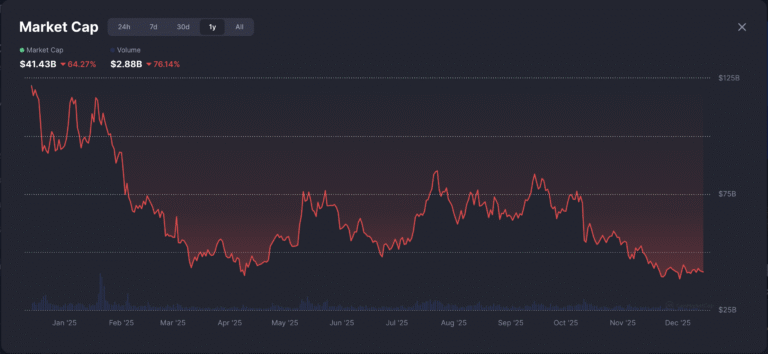

The memecoin sector declined significantly in 2025. Source: CoinMarketCap

He compared current sentiment around memecoins to early skepticism about social media following the initial wave of platforms in the early 2000s, suggesting that a subsequent iteration could drive broader adoption.

Memecoins were among the strongest-performing crypto segments in 2024 and dominated market narratives that year, according to data from crypto analytics platform CoinGecko. However, rising criticism that memecoins and other social tokens lack fundamental value, combined with a series of high-profile failures, led to a sharp market retracement and a shift in investor focus.

Political token launches and the memecoin downturn

The memecoin market deteriorated in Q1 2025 following prominent token collapses and large drawdowns that were widely described as “rug pulls.”

United States President Donald Trump launched a memecoin ahead of the January 2025 inauguration. The token reached a peak price of $75 before dropping by more than 90% to about $5.42 at the time of writing, according to CoinMarketCap.

In February, Argentina’s President Javier Milei endorsed a social token called Libra, which subsequently crashed. According to community analyses, 86% of LIBRA holders realized losses of $1,000 or more. The token had reached a market capitalization of $107 million before its collapse and was labeled a rug pull by segments of the crypto community.

Milei later sought to distance himself from the launch. Authorities opened an investigation into his involvement, followed by lawsuits from retail investors and impeachment calls from some Argentine lawmakers.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.