Circle to Acquire Interop Labs Team & IP; Axelar Independent

Circle has agreed to acquire the Interop Labs team and its proprietary technology, adding a core contributor to the Axelar Network to its infrastructure unit. The transaction, which includes Interop Labs’ personnel and intellectual property, is expected to close in early 2026. The Axelar Network, its foundation and the AXL token will remain independent and community-governed. Financial terms were not disclosed.

Interop Labs is the initial developer of the Axelar Network, a decentralized interoperability platform that enables crosschain messaging and asset transfers between blockchains. Circle said the team’s technology will be integrated into Circle’s Arc blockchain and its Cross-Chain Transfer Protocol (CCTP).

Another Axelar contributor, Common Prefix, will assume Interop Labs’ former development responsibilities to ensure continuity on the open-source network. According to Circle, the acquisition is expected to accelerate interoperability for assets issued on Arc, improve developer tooling for multichain applications and support the development of Circle-built products.

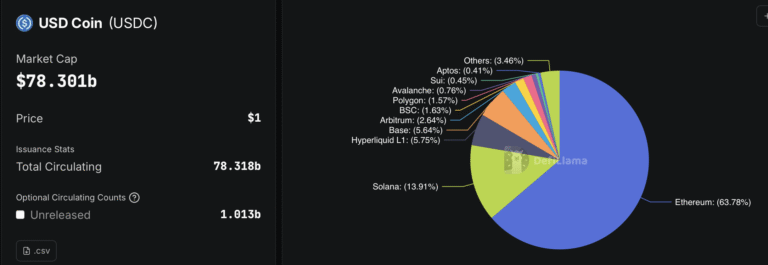

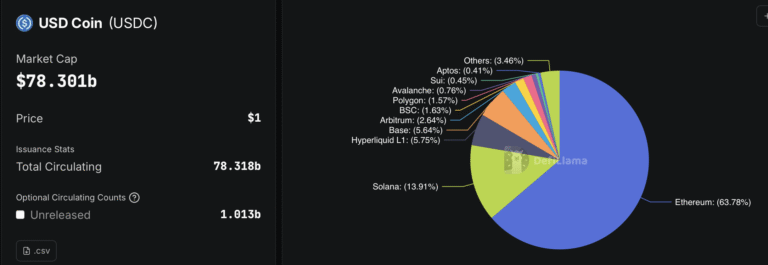

Circle issues USDC (USDC), the second-largest stablecoin by market capitalization, representing roughly 25% of the $310 billion global stablecoin market, according to DefiLlama.

In January, Circle purchased Hashnote, the issuer of the tokenized money market fund US Yield Coin, bringing one of the largest yield-bearing real-world asset products into its stablecoin and infrastructure operations.

Stablecoin issuers pursue acquisitions in 2025

In November, Paxos acquired institutional crypto wallet provider Fordefi in a deal valued at more than $100 million, according to Fortune. Paxos, the issuer of Pax Dollar (USDP) and PayPal’s USD (PYUSD), said the acquisition strengthens its custody and transaction infrastructure for stablecoin issuance, asset tokenization and onchain payments.

Tether, the dominant stablecoin issuer behind the USDt (USDT) token, has used its balance sheet to take minority stakes and strategic positions across traditional asset businesses. In June, it acquired a roughly 32% stake in Canada-listed gold royalty company Elemental Altus Royalties for about $89 million. In November, Tether Investments bought a minority stake in precious metals company Versamet Royalties, purchasing about 11.8 million common shares through a private agreement with an existing shareholder.

On Dec. 12, Tether submitted a binding all-cash offer to acquire Exor’s 65.4% controlling stake in Italy’s Juventus Football Club, an offer that Exor later said its board unanimously rejected.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.