Lyn Alden: Fed enters gradual money printing, mild asset lift

The United States Federal Reserve is moving toward a gradual expansion of its balance sheet that may provide modest support to asset prices, rather than the large-scale easing some Bitcoin (BTC) market participants anticipated, according to economist and Bitcoin advocate Lyn Alden.

In a Feb. 8 investment strategy newsletter, Alden said her base case generally aligns with the Fed’s outlook: the central bank’s balance sheet would grow at approximately the same proportional pace as total bank assets or nominal gross domestic product (GDP). She added that this view supports owning high-quality scarce assets, with a preference to rebalance away from areas showing extreme euphoria and toward under-owned segments.

Federal Reserve M2, a measure of the money supply, has continued to expand over time. Source: FRED

Alden’s comments followed U.S. President Donald Trump’s nomination of Kevin Warsh to serve as the next Federal Reserve chair, a development that stirred markets as traders viewed Warsh as potentially more hawkish on interest rates than other candidates.

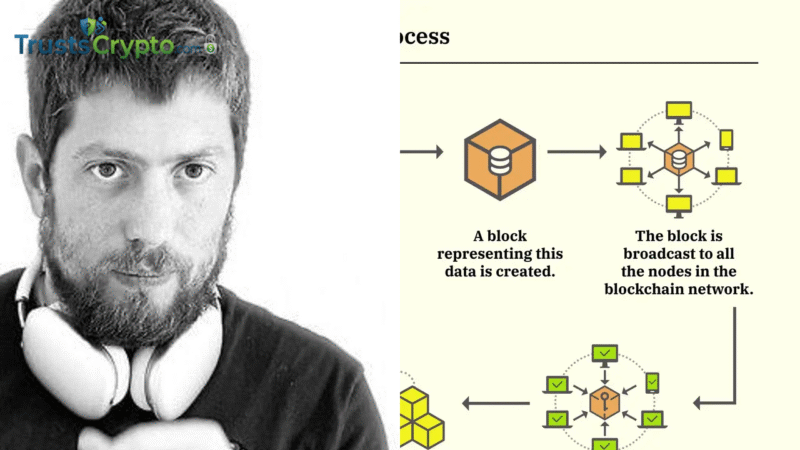

Interest-rate policy can affect cryptocurrency prices. Expanding credit and increasing the money supply are typically considered supportive for risk assets, while tighter policy via higher interest rates can slow economic activity and pressure prices.

No rate cut expected at next FOMC meeting

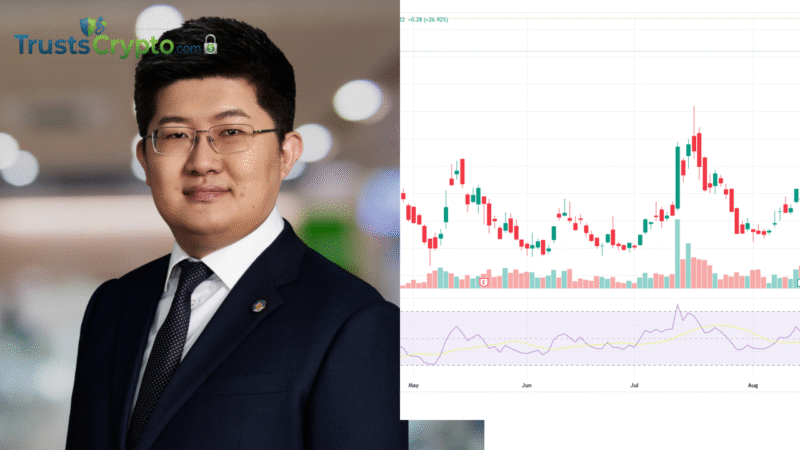

About 19.9% of traders expect a rate cut at the March Federal Open Market Committee (FOMC) meeting, down from 23% on Saturday, according to CME FedWatch data.

Target rate probabilities ahead of the March FOMC meeting. Source: CME Group

Current Federal Reserve Chair Jerome Powell has issued mixed forward guidance on interest-rate policy despite cutting rates several times in 2025. “In the near term, risks to inflation are tilted to the upside and risks to employment to the downside, a challenging situation. There is no risk-free path for policy,” Powell said following the December FOMC meeting.

Powell’s term as chair expires in May 2025, and Warsh has not yet been confirmed by the U.S. Senate, adding to investor uncertainty about the trajectory of interest-rate policy into 2026.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.