Binance Adds $300M in Bitcoin to SAFU Amid Market Downturn

News

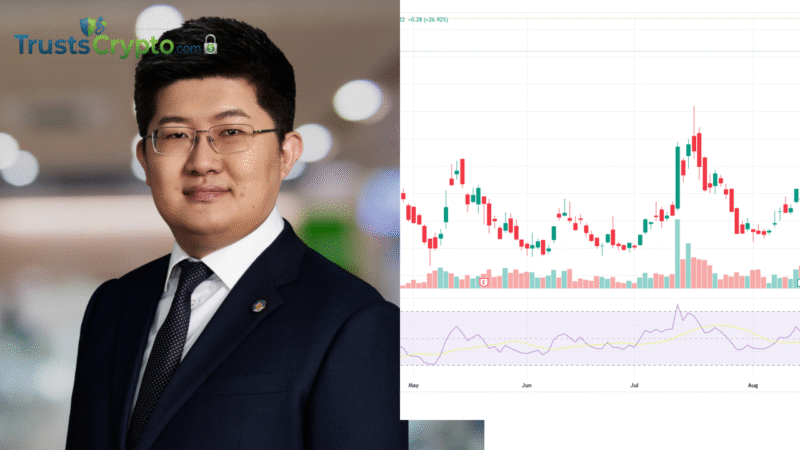

Binance added approximately $300 million worth of Bitcoin to its Secure Asset Fund for Users (SAFU) on Monday, bringing the value of the fund’s Bitcoin holdings to more than $720 million at current prices, according to blockchain data provider Arkham.

Arkham data indicates the purchase amounted to 4,225 Bitcoin (BTC), acquired for the SAFU wallet that serves as the exchange’s emergency reserve.

“We’re continuing to acquire #Bitcoin for the SAFU fund, aiming to complete conversion of the fund within 30 days of our original announcement,” Binance stated in a post on X on Monday.

While the move reflects the exchange’s confidence in Bitcoin, concentrating SAFU assets in BTC also subjects the reserve’s value to Bitcoin’s price volatility, which could reduce the overall size of the fund during market downturns.

Binance announced on Jan. 30 that it would transition $1 billion of its user-protection fund into Bitcoin, citing long-term confidence in the asset. The exchange said it would restore the fund to $1 billion if market fluctuations pushed its value below $800 million.

Binance SAFU Fund. Source: Arkham

Market sentiment remains fragile

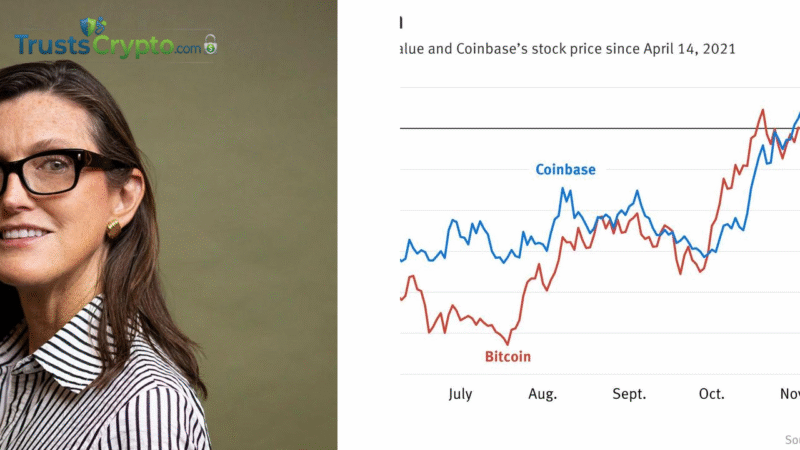

The fund conversion is taking place amid a broader crypto market pullback. Bitcoin fell to $59,930 on Friday, a level last seen in October 2024 prior to the re-election of U.S. President Donald Trump, according to TradingView.

BTC/USD, 2-year chart, weekly timeframe. Source: Cointelegraph/TradingView

Investor sentiment remains cautious, and further declines are possible in the absence of supportive catalysts, said Hina Sattar Joshi, director for digital assets at TP ICAP, noting that many market participants continue to look to Bitcoin’s historical four-year “boom-and-bust” cycle.

Positioning from high-performing “smart money” traders also reflects a defensive stance. Data from Nansen shows these traders added $7.38 million in leveraged short positions and were net short Bitcoin by a cumulative $109 million, with activity routed through the Hyperliquid exchange.

Across major tokens, smart money accounts were generally positioned for further downside, with the exception of Avalanche (AVAX), which recorded $7.38 million in cumulative long positions.

Disclaimer: This report is based on publicly available on-chain and market data, including Arkham, TradingView, and Nansen. The information is intended for general informational purposes only and should not be construed as investment advice. Readers should conduct their own due diligence.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.