Ether’s MVRV Z-Score Hits Capitulation; Analysts Divided

News

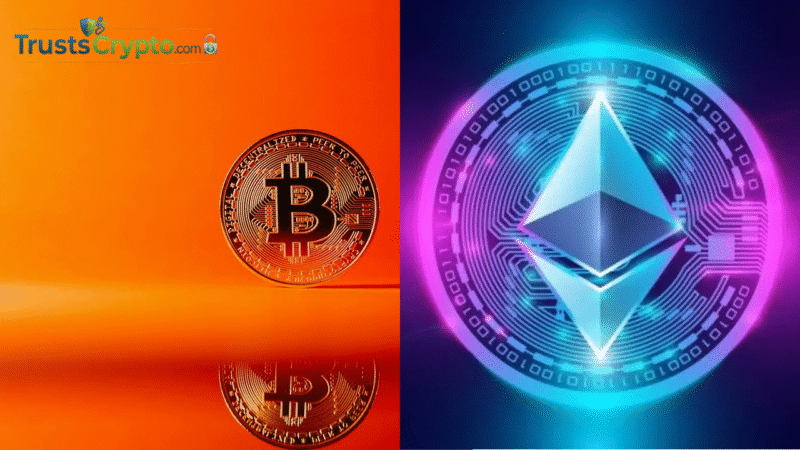

Ethereum’s MVRV Z-Score fell to -0.42, a level typically associated with capitulation, after the asset declined 30% over the past two weeks. Analysts remain divided on whether Ether is nearing a bottom.

The MVRV Z-Score compares an asset’s market value to its realized value — the aggregate value based on the last transacted prices — to highlight periods of overvaluation, undervaluation, or market capitulation.

CryptoQuant analyst and Alphractal founder and CEO Joao Wedson said the latest reading “shows that Ethereum is indeed going through a clear capitulation process.” He added, however, that the current move “does not compare to the intensity” seen at major lows in 2018 and 2022. According to Wedson, the historical trough for the metric was -0.76 in December 2018.

Ether MVRV Z-Score tanks below zero in capitulation. Source: Alphractal

Further downside risk for ETH remains

Wedson cautioned that additional declines may occur before a durable recovery emerges. “The market is already under stress, but historically, there is still room for further downside before a definitive structural bottom is formed,” he said.

Ether has dropped 30% in the past fortnight, hitting a bear market low of $1,825 on Friday before rebounding to about $2,100 on Monday.

HashKey Group senior researcher Tim Sun said that historically, Ethereum’s MVRV Z-Score “has proven to be a highly reliable indicator for tracking subsequent market shifts, particularly in identifying bottoming zones across multiple cycles.” He noted that on-chain activity, protocol development, and the broader ecosystem show no substantive deterioration and continue to strengthen in several areas.

Sun added that it is too early to confirm that Ether has completed its bottoming process while the main factors behind the decline persist. He cited potential liquidity pressures tied to the upcoming April tax season as a key risk for further downside.

Some market participants see opportunity to buy weakness

MN Fund founder Michaël van de Poppe said current conditions could present “a tremendous opportunity to be looking at ETH,” pointing to what he described as a wide gap to the asset’s “fair price” based on the MVRV ratio.

He added that ETH appears as undervalued as during the April 2025 crash, the June 2022 bottom following the Terra/Luna collapse, the March 2020 Covid-driven sell-off, and the December 2018 bear market low — periods that historically offered strong entry points.

Andri Fauzan Adziima, research lead at crypto trading platform Bitrue, said negative MVRV readings “have repeatedly preceded explosive recoveries in past cycles.” With ETH’s network metrics “holding strong,” he views the backdrop as conducive to long-term accumulation once weaker hands exit. “Brutal capitulation now, but historically one of the best ‘buy fear’ windows for ETH.”

ETH prices have tanked back to long-term cycle lows. Source: TradingView

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.