LayerZero to Launch ‘Zero’ L1 in 2026, Backed by ARK, Citadel

LayerZero Labs plans to launch a new layer-1 blockchain, “Zero,” in the fall of 2026, with backing from ARK Invest and Citadel Securities and a focus on institutional financial markets.

According to a company announcement on Tuesday, Zero is designed to scale to two million transactions per second by using zero-knowledge proofs and the Jolt zero-knowledge virtual machine. LayerZero Labs said these technologies are intended to bypass a “fundamental replication requirement” that limits many blockchains to fewer than 10,000 transactions per second.

Zero is set to debut with three permissionless environments, or “zones,” governed by the underlying network. Interoperability between zones and across more than 165 blockchains will be enabled by the network’s native token and governance asset, LayerZero (ZRO), the firm said.

LayerZero Labs CEO Bryan Pellegrino said Zero’s architecture “moves the industry’s roadmap forward by at least a decade,” adding that the company believes the technology could support bringing “the entire global economy on-chain.”

The company said Zero introduces four 100x improvements across key components:

- Storage: QMDB

- Compute: FAFO

- Networking: SVID

- Zero-knowledge proving: Jolt Pro

LayerZero Labs characterized Zero as decentralized, permissionless, and censorship-resistant.

Institutional backing and governance

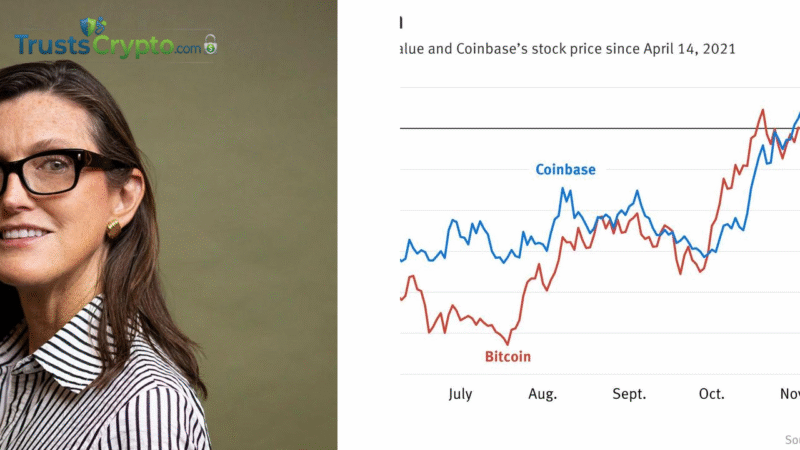

ARK Invest is becoming a shareholder in LayerZero equity and ZRO, while Citadel Securities has made a strategic investment in the token, according to the announcement.

ARK Invest CEO Cathie Wood will join Zero’s advisory board, alongside Michael Blaugrund, vice president of strategic initiatives at Intercontinental Exchange (ICE), and Caroline Butler, former head of digital assets at BNY Mellon.

Tether’s investment arm also announced a strategic investment in LayerZero Labs on Tuesday.

Prospective enterprise adoption

Google Cloud is partnering with LayerZero Labs to explore how AI agents could conduct micropayments and trade without a bank account.

ICE is evaluating Zero for potential use in trading and clearing infrastructure to support 24/7 markets and the integration of tokenized collateral.

The Depository Trust & Clearing Corporation aims to use Zero to enhance the scalability of its tokenization service and collateral app chain, according to the announcement.

Decentralized trading platform Global Token Exchange said it plans to build the treasury layer of its decentralized system, Turbo, on Zero in a post on X on Tuesday.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.