Trump Media Files for Bitcoin/Ether and Cronos Crypto ETFs

Trump Media & Technology Group has submitted filings to the United States Securities and Exchange Commission for two exchange-traded funds linked to major cryptocurrencies, proposing products tied to Bitcoin (BTC), Ether (ETH), and Cronos (CRO).

The company’s Truth Social Funds division announced plans for the Truth Social Bitcoin and Ether ETF and the Truth Social Cronos Yield Maximizer ETF. The filings have not taken effect and remain subject to SEC review.

Yorkville America Equities will serve as investment adviser to both funds. The products are planned in partnership with Crypto.com, which, pending regulatory approval, is expected to provide custody, liquidity, and staking services. Investor access would be offered through Foris Capital US LLC, Crypto.com’s broker-dealer. Each ETF is expected to carry a 0.95% management fee. Yorkville America Equities president Steve Neamtz said the platform aims to give investors exposure across digital assets with potential for capital appreciation and income.

Proposed ETFs to track BTC, ETH, and CRO with staking features

The Bitcoin and Ether fund is designed to reflect the combined performance of the two largest cryptocurrencies by market capitalization, while also capturing staking rewards generated by Ether. The Cronos Yield Maximizer ETF would follow the performance of CRO, the native token of Crypto.com’s Cronos blockchain, and include staking income.

Trump Media, the parent company of the Truth Social platform, has expanded its cryptocurrency initiatives in recent months. In April last year, it announced an agreement with Crypto.com and Yorkville America Digital to develop a series of “Made in America” ETFs combining digital assets and traditional securities across sectors such as energy. In September, the firm and Crypto.com reached a deal to establish a joint treasury focused on accumulating CRO, beginning with an initial purchase of approximately 684.4 million CRO valued at about $105 million through a mix of stock and cash.

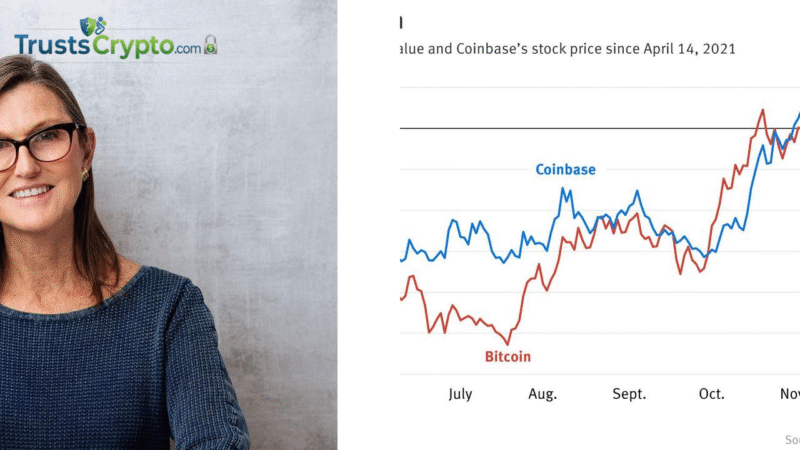

Spot Bitcoin ETFs log four consecutive weeks of outflows

U.S. spot Bitcoin ETFs have recorded four straight weeks of net outflows, with roughly $360 million withdrawn in the most recent week, according to data from SoSoValue.

Flows were volatile but net negative across late January and early February. The largest recent daily withdrawals included $817.87 million on Jan. 29, $509.70 million on Jan. 30, and $544.94 million on Feb. 4. Positive sessions were smaller, including inflows of $561.89 million on Feb. 2, $371.15 million on Feb. 6, $166.56 million on Feb. 10, and $145.00 million on Feb. 9, with just $15.20 million entering on Friday.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.