Crypto Today: WLFI Charter Scrutiny, Stablecoin Talks, AI Power

U.S. House Democrats pressed the Treasury Department on a proposed national trust bank charter tied to a dollar-backed token, the White House steered industry talks toward limits on stablecoin rewards, and publicly listed Bitcoin miners outlined plans for roughly 30 gigawatts of power capacity focused on artificial intelligence workloads.

House Democrats press Treasury on WLFI bank charter and UAE stake

In a letter dated Thursday, 41 Democrats on the House Financial Services Committee led by Representative Gregory Meeks asked Treasury Secretary Scott Bessent how regulators are addressing World Liberty Financial’s application for a national trust bank charter to issue a dollar-pegged token. The lawmakers cited concerns over systemic risk, foreign ownership, and possible political influence on the chartering process, and requested details on safeguards to prevent foreign officials or politically connected investors from using the process to gain leverage over the U.S. financial system.

The letter referenced reporting that a senior royal from the United Arab Emirates quietly acquired nearly half of World Liberty Financial for about $500 million — including a reported $187 million directed to Trump-affiliated entities — while the firm sought a national trust bank charter from the Office of the Comptroller of the Currency (OCC). The lawmakers said the combination of digital asset trust structures, untested liquidity and resolution frameworks, and foreign political interests raises issues regulators “cannot afford to sidestep.”

Letter from House Democrats to Treasury Secretary Scott Bessent. Source: Meeks.house.gov

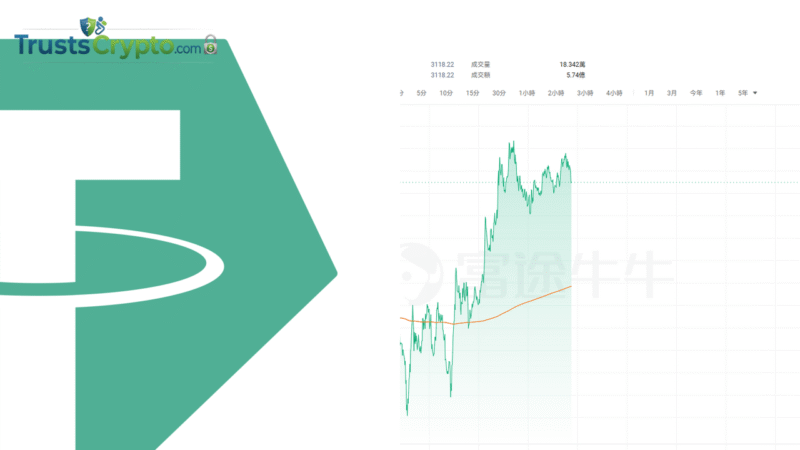

White House floats stablecoin reward limits in latest crypto, bank talks

The White House reportedly refocused negotiations between crypto and banking industry representatives on how stablecoin rewards should be paid during a third meeting held Thursday on a crypto market structure bill. According to reports by Semafor’s Eleanor Mueller and journalist Eleanor Terrett, White House crypto adviser Patrick Witt led the discussion and advanced a previously proposed framework allowing third parties to provide stablecoin rewards based on transactions and user activity, rather than account balances — a point of contention for banks.

No agreement was reached. Ripple’s chief legal officer, Stuart Alderoty, said participants “rolled up our sleeves and went through specific language,” while Coinbase’s chief legal officer, Paul Grewal, described the meeting as “constructive and the tone cooperative.” It marked the third session among the parties, following meetings on Feb. 2 and Feb. 10, as the Senate considers legislation defining how U.S. market regulators would oversee crypto. Progress has stalled amid disagreements over language related to stablecoin reward restrictions.

Bitcoin miners target 30 GW of AI capacity amid hashprice pressure

Publicly traded Bitcoin (BTC) miners plan approximately 30 gigawatts (GW) of new power capacity aimed at artificial intelligence workloads, nearly triple the 11 GW currently online, as firms seek to offset compressed mining margins and prepare for potential growth. TheEnergyMag compiled the figures across 14 publicly listed bitcoin miners, highlighting an accelerated pivot away from traditional hashpower in a period of persistently weak hashprice conditions.

On paper, the expansion approximates what TheEnergyMag described as “a small country’s worth of power infrastructure.” In practice, much of the 30 GW remains in development pipelines, interconnection queues, or early-stage planning, rather than operational sites. TheEnergyMag added that monetization will ultimately depend on whether AI demand stays sufficiently strong to support the scale of investment.

Current and proposed power capacities of public Bitcoin miners. Source: TheEnergyMag

Disclosure: This report is based on publicly available information and statements from named sources. Readers should independently verify key details.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.