Major US Banks Pilot Crypto With Coinbase, Says Armstrong

Major U.S. banks are conducting early pilots for stablecoins, crypto custody, and digital-asset trading in collaboration with Coinbase, CEO Brian Armstrong said at The New York Times DealBook Summit. According to Bloomberg, Armstrong did not name the institutions and warned that banks slow to adopt crypto “are going to get left behind.” He spoke alongside BlackRock CEO Larry Fink during a panel at the event.

Armstrong rejected the notion that Bitcoin could fall to zero. Fink said he now sees a significant use case for Bitcoin but cautioned that the market is still heavily influenced by leveraged participants.

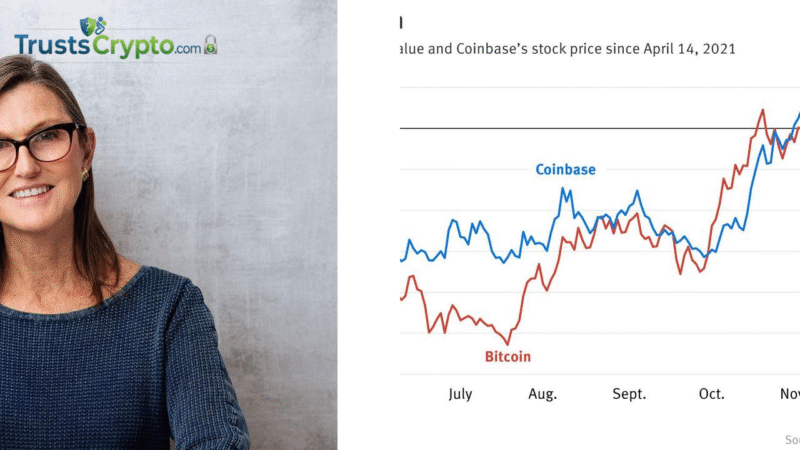

BlackRock’s iShares Bitcoin Trust (IBIT), launched in January 2024, is currently the largest spot Bitcoin ETF with a market capitalization of over $72 billion, according to CoinMarketCap. BlackRock also manages the largest tokenized U.S. Treasury product by market cap, with approximately $2.3 billion in assets, according to data from RWA.xyz.

The battle between banks and Coinbase

Despite Armstrong’s statements about collaboration with certain major banks, relations between Coinbase and parts of the banking sector have grown more contentious in recent months.

In August, the Banking Policy Institute, a lobbying group chaired by JPMorgan’s Jamie Dimon, warned Congress that stablecoins could undermine the banking sector’s credit model. The organization urged lawmakers to tighten the GENIUS Act, arguing that a shift from bank deposits to stablecoins could increase lending costs and reduce credit available to businesses.

Traditional banks have also pointed to what they view as a loophole in the U.S. GENIUS Act, which prohibits stablecoin issuers from offering yield while allowing third parties, such as Coinbase, to do so.

In September, Armstrong told Fox Business that Coinbase aims to replace traditional banks by becoming a “super app” offering credit cards, payments, and rewards. He described the legacy banking system as outdated, citing the “three percent” fees charged on credit card transactions.

In November, the Independent Community Bankers of America urged the Office of the Comptroller of the Currency to deny Coinbase’s application for a national trust charter, asserting that the exchange’s crypto-custody model is untested.

Paul Grewal, Coinbase’s chief legal officer, responded on X, saying bank lobbyists were trying to erect regulatory barriers to protect their own interests and that efforts ranging from undoing a law to target rewards to opposing charters amounted to protectionism rather than consumer protection.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.