CFTC approves spot crypto, EU eyes ESMA powers, Ethereum Fusaka

Here are the key developments in crypto today, covering market structure, regulation and network upgrades across the United States, Europe and Ethereum.

CFTC approves spot crypto trading on U.S. futures exchanges

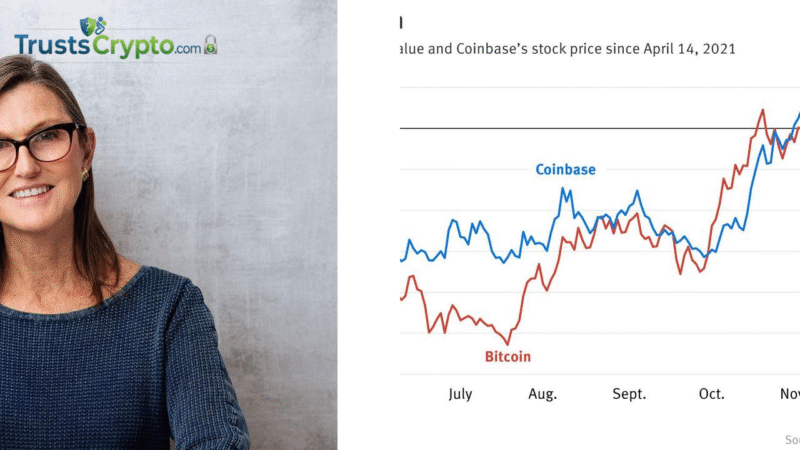

The U.S. Commodity Futures Trading Commission authorized spot cryptocurrency products to be listed on federally regulated futures exchanges, according to a notice published Thursday. Acting CFTC Chair Caroline Pham said the action follows policy directives from U.S. President Donald Trump, recommendations from the President’s Working Group on Digital Asset Markets, engagement with the Securities and Exchange Commission, and findings from the CFTC’s “Crypto Sprint” initiative.

Pham said this marks the first time spot crypto assets can trade on CFTC-registered exchanges, bringing long-standing exchange standards, customer protections and market integrity to the products.

Pham, who became acting chair in January as the new administration took office, is expected to depart once the Senate confirms a successor. Michael Selig, an SEC official nominated by President Trump to chair the CFTC, is anticipated to receive a Senate floor vote following a committee advance.

EU proposal expands ESMA authority over crypto and capital markets

The European Commission on Thursday proposed enhancing the European Securities and Markets Authority’s powers across crypto and broader financial markets to help close the competitiveness gap with the United States. The package would shift “direct supervisory competences” for key market infrastructure to ESMA, including crypto-asset service providers (CASPs), trading venues and central counterparties, while strengthening its coordination role in asset management.

The proposal requires approval from the European Parliament and the Council, where negotiations are ongoing. If adopted, ESMA’s oversight of EU capital markets would more closely align with the centralized model of the U.S. Securities and Exchange Commission.

In September, France became the third EU member state to back transferring supervision of major crypto firms to the Paris-based ESMA, joining regulators in Austria and Italy. The push followed scrutiny of Malta’s crypto licensing regime; in July, ESMA’s peer review of the Malta Financial Services Authority’s authorization of a crypto service provider found the regulator only “partially met expectations.”

Ethereum’s Fusaka upgrade activates on mainnet

Ethereum’s second major upgrade of the year, Fusaka, activated on the mainnet at 9:49 pm UTC on Wednesday. The release is designed to increase data capacity, lower transaction costs and improve usability. Earlier in the week, the Ethereum Foundation said Fusaka moves the network closer to “near-instant transactions,” aiming to streamline the user experience.

According to the Ethereum team, the upgrade enables PeerDAS, targeting up to 8x data throughput for rollups, introduces user experience improvements via the R1 curve and pre-confirmations, and prepares Layer 1 scaling with a gas limit increase. Community monitoring will continue over the next 24 hours.

The changes are expected to “unlock up to 8x data throughput” for layer-2 solutions and rollups with lower fees, as nodes download and upload less data, improving processing speed and enabling more efficient interactions with the Ethereum mainnet.

Ether (ETH) gained 3.5% on the day, easing from a session high above $3,200. Several analysts said the token could see further upside as Fusaka’s underlying enhancements take effect.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.