After 17 years, ETF expert says Bitcoin isn’t like tulips

Bitcoin should no longer be likened to the Dutch “tulip mania” because of its longevity and repeated recoveries, according to Eric Balchunas, an exchange-traded fund specialist at Bloomberg. The senior ETF analyst said on Sunday that, regardless of recent declines, the asset’s history makes tulip comparisons outdated.

Balchunas noted that the tulip market rose and collapsed within roughly three years, whereas Bitcoin (BTC) has endured for 17 years and rebounded from “six to seven” major downturns to record new all-time highs. He added that Bitcoin remains up about 250% over the past three years and gained 122% last year, underscoring its resilience.

Criticism persists, however. Earlier this month, “The Big Short” investor Michael Burry described Bitcoin as “the tulip bulb of our time.” In 2017, JPMorgan CEO Jamie Dimon called Bitcoin “worse than tulip bulbs” and a “fraud.”

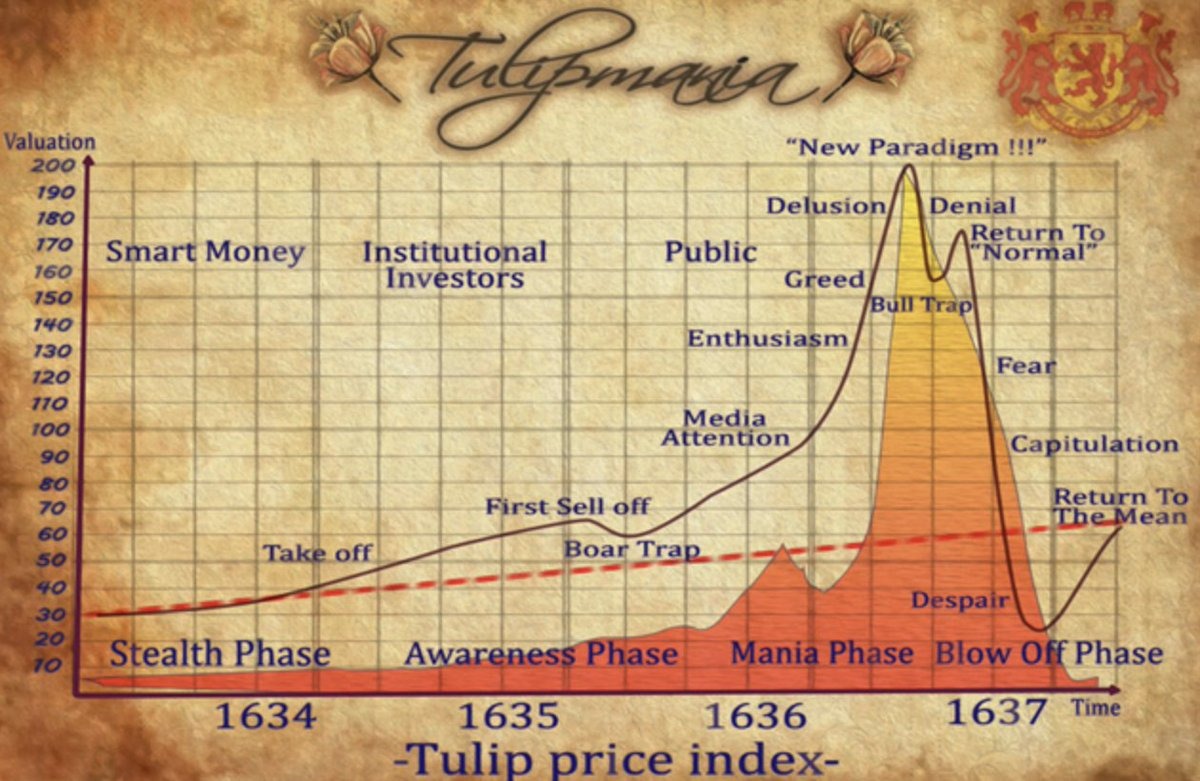

Tulip market boom and bust within three years

The Dutch tulip mania was a speculative surge during the Netherlands’ Golden Age, when tulip bulbs—introduced to Europe from Turkey—became status symbols among affluent merchants. Prices accelerated in 1634 and hit a peak in 1636, with some rare bulbs selling for more than the cost of a house in Amsterdam, before the market collapsed in 1637 with prices plunging by over 90% within weeks.

The episode is widely cited as one of the earliest recorded speculative bubbles and helped popularize the archetypal “pump and dump” price pattern.

Bitcoin vs. tulips: limits of the comparison

Balchunas said Bitcoin’s performance this year largely reflects a giveback of last year’s excess. He added that even if 2025 finishes flat or slightly negative, BTC would still be trading at around 50% of its annual average, emphasizing that assets—including equities—periodically cool off and that recent moves may be overinterpreted.

Addressing claims that Bitcoin is a non-productive asset, Balchunas pointed out that gold, fine art such as Picasso works, and rare stamps are also non-productive yet retain value. He argued tulips were characterized by a brief euphoria followed by collapse, whereas Bitcoin is fundamentally different.

Garry Krug, head of strategy at German Bitcoin treasury firm Aifinyo, added that bubbles do not typically withstand multiple market cycles, regulatory disputes, geopolitical shocks, halvings, and exchange failures while subsequently returning to new highs.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.