Bitcoin ETFs see $434M outflows as BTC tests $60K amid ETF debate

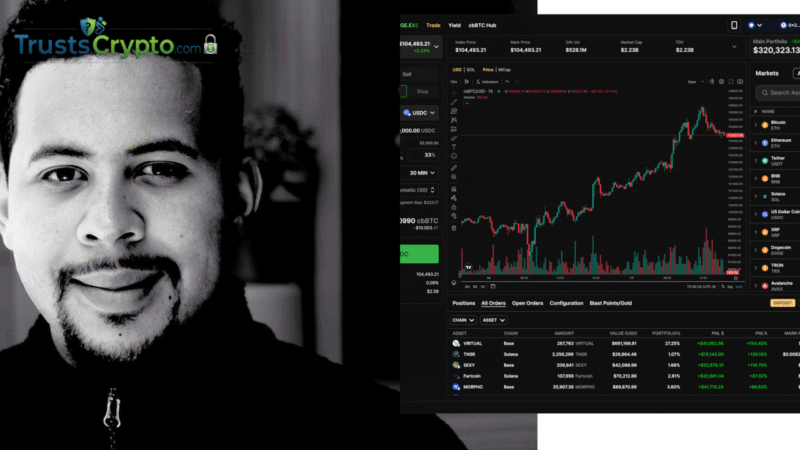

Spot Bitcoin exchange-traded funds (ETFs) registered $434 million in net outflows on Thursday, bringing redemptions over the last two sessions to almost $1 billion as scrutiny of the vehicles’ market impact increases, according to SoSoValue.

Data from SoSoValue shows $434 million exited spot Bitcoin (BTC) ETFs on Thursday, following $545 million in withdrawals on Wednesday.

Monday’s $561 million of inflows did not offset subsequent redemptions, leaving net weekly outflows at about $690 million as of Friday morning.

Spot Bitcoin ETF flows since Monday. Source: SoSoValue

The latest outflows coincided with a sharp move lower in Bitcoin’s price, which briefly touched $60,000 for the first time since October 2024, according to CoinGecko.

Market participants have not pinpointed a definitive catalyst for the pullback, and the downturn has renewed criticism of Bitcoin ETFs even as some analysts highlight the products’ durability.

The January 2024 debut of spot Bitcoin ETFs was widely anticipated and expected to accelerate BTC adoption through institutional channels.

Some analysts contend that institutionalization via ETFs may have had unintended consequences, arguing it could dilute Bitcoin’s scarcity — a core attribute tied to its fixed supply of 21 million coins.

“The same 1 BTC can now support an ETF unit, a future contract, a perpetual swap, an options delta, a broker loan, a structured note. All at once,” Bob Kendall, technical analyst and author of The Kendall Report, said in a Wednesday X post.

“That is not a market. That is a fractional reserve price system,” he added.

Source: Bob Kendall

Kendall’s comments echo prior concerns that Bitcoin ETFs could become tools for Wall Street to trade against the asset.

Before crypto ETFs launched, Josef Tětek, a Bitcoin analyst at hardware wallet provider Trezor, cautioned that such products might enable the “creation of millions of unbacked Bitcoin,” potentially weighing on the price of BTC held directly.

As of Friday, total assets in spot Bitcoin ETFs were approximately $81 billion, with cumulative net flows of $54.3 billion, according to SoSoValue.

Altcoin ETF activity was mixed: Ether (ETH) funds saw $80.8 million in outflows, while XRP (XRP) and Solana (SOL) ETFs recorded modest inflows of $4.8 million and $2.8 million, respectively.

This report aims to provide accurate, timely information in line with editorial standards. Readers are encouraged to verify details independently.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.