Bitcoin Sharpe Ratio at Bear-Market Lows; Caution on Reversal

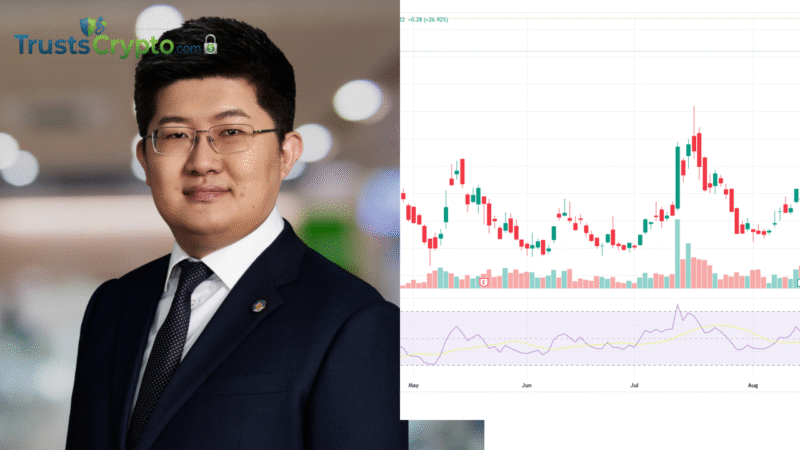

Bitcoin’s Sharpe ratio has declined to -10, approaching levels observed at prior bear-market troughs in 2018 and 2022, indicating the risk-to-return profile is moving toward extreme conditions.

The metric, which evaluates Bitcoin’s (BTC) returns relative to risk, has moved into negative territory that has historically coincided with late-stage bear markets, according to CryptoQuant analyst Darkfost. “The Sharpe ratio has just entered a particularly interesting zone, one that has historically aligned with the final phases of bear markets,” the analyst said on X on Saturday. They added that this does not necessarily confirm an end to the downturn, but suggests the risk-reward setup is becoming extreme.

CryptoQuant data shows the ratio at -10, its lowest reading since March 2023. The Sharpe ratio measures how much return an investor could expect per unit of risk taken.

Negative reading points to potential inflection

The ratio was lower in late 2022 to early 2023 and in late 2018 to early 2019, periods that marked the depths of previous bear cycles. The metric fell to zero in November 2025 when BTC prices reached a local low of $82,000.

In practical terms, the analyst noted that risk tied to BTC investments remains elevated relative to recent returns. “The ratio is still deteriorating, showing that BTC’s performance is not yet attractive compared to the risk being taken,” they said. However, they added that negative Sharpe readings often emerge near turning areas: “We are gradually approaching an area where this trend has historically reversed.”

Reversal may still take months

The analyst cautioned that this phase could persist for several more months and that BTC may continue to correct before a sustained reversal occurs.

Separately, 10x Research advised caution in a Monday market update, stating: “While sentiment and technical indicators are approaching extreme levels, the broader downtrend remains intact. In the absence of a clear catalyst, there is little urgency to step in.”

BTC fell to $60,000 on Friday before rebounding to $71,000 by Monday. The asset remains 44% below its October peak of $126,000, and analysts say sentiment is still consistent with bear-market conditions.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.