Bitcoin Treasury Firms Enter Darwinian Phase as Premiums Fall

Bitcoin-focused treasury companies have entered a “Darwinian phase” as equity premiums compress, leverage turns into a drag, and digital asset treasury (DAT) stocks swing to discounts, according to a new analysis from Galaxy Research.

Galaxy said the DAT trade appears to have reached its limit after equity prices fell below the net asset value (NAV) of their Bitcoin (BTC) holdings, reversing the issuance-driven growth flywheel and converting leverage into a liability.

The shift followed Bitcoin’s decline from its October high near $126,000 to lows around $80,000, which curtailed risk appetite and drained market liquidity. The Oct. 10 deleveraging event accelerated the move by wiping out open interest in futures and weakening spot market depth. For treasury firms whose shares functioned as leveraged crypto exposure, the adjustment has been sharp, Galaxy noted, adding that the financial engineering that boosted upside is now amplifying losses.

DAT stocks trade at discounts

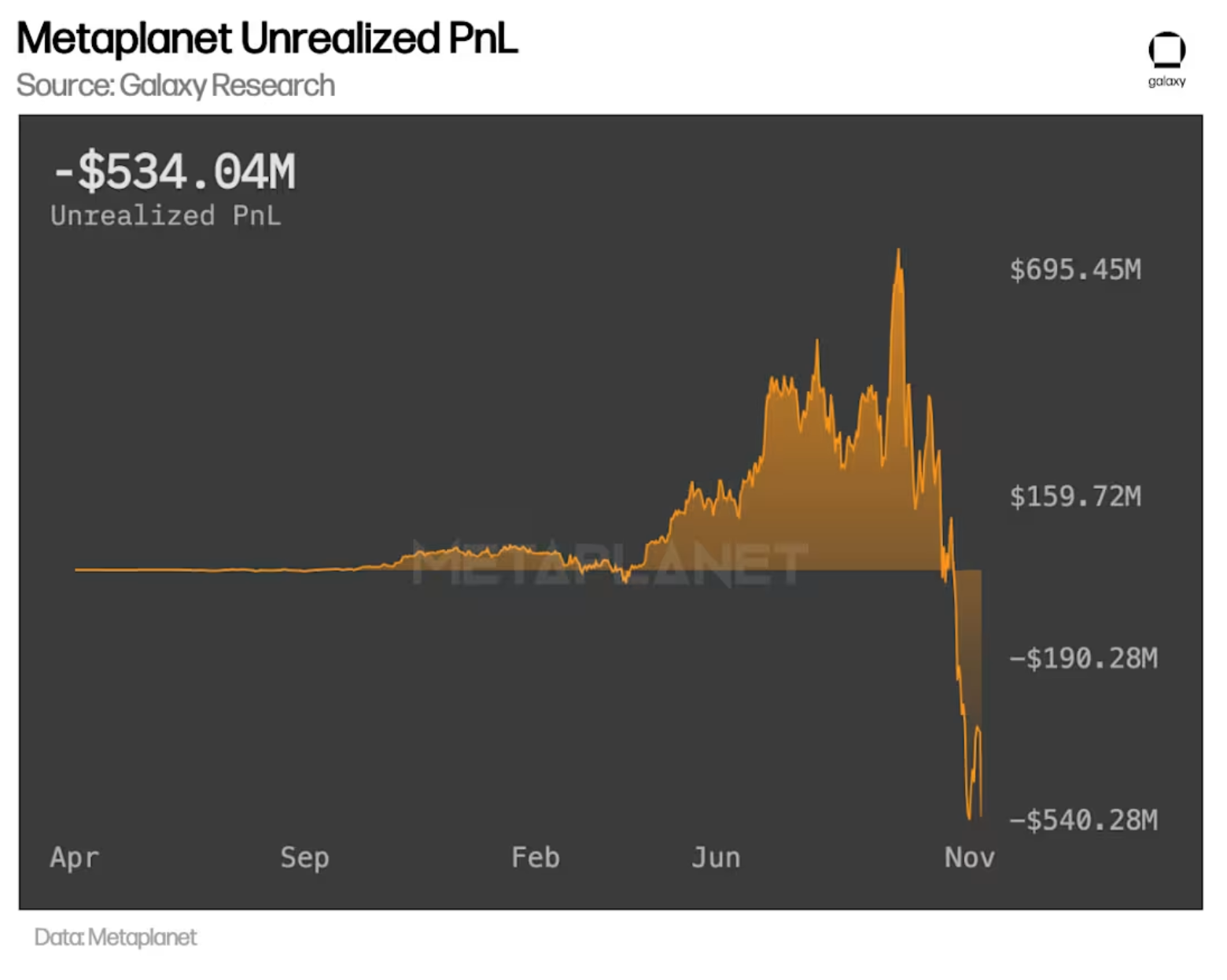

DAT equities that traded at substantial premiums to NAV over the summer are now mostly at discounts, even though Bitcoin is down only about 30% from its peak. Companies such as Metaplanet and Nakamoto, which previously reported hundreds of millions in unrealized gains, are now in the red as average BTC purchase prices sit above $107,000. Galaxy said embedded leverage is exposing these firms to severe downside, with one company, NAKA, falling more than 98% from its high. The firm added that the recent price action resembles wipeouts typically seen in memecoin markets.

With issuance no longer available, Galaxy outlined three paths forward. Its base case is a prolonged period of compressed premiums, during which BTC-per-share growth stagnates and DAT equities carry more downside than Bitcoin. A second outcome is consolidation, where firms that issued aggressively at high premiums, bought BTC near the top, or took on significant debt face solvency pressure and may be acquired or restructured. A third scenario allows for recovery if Bitcoin reaches new all-time highs, but primarily for companies that preserved liquidity and avoided over-issuing during the upcycle.

Strategy raises $1.44 billion to address dividend concerns

On Friday, Strategy CEO Phong Le said the company established a new $1.44 billion cash reserve to ease investor concerns about meeting dividend and debt obligations during Bitcoin’s downturn. Funded via a stock sale, the reserve is intended to cover at least 12 months of dividend payments, with plans to extend that buffer to 24 months.

Separately, Bitwise chief investment officer Matt Hougan said Strategy would not be forced to sell Bitcoin to remain afloat if its share price declines, calling claims to the contrary “just flat wrong.”

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.