Bitnomial Gains CFTC Approval to Launch US Prediction Markets

Bitnomial Clearinghouse LLC has received approval from the U.S. Commodity Futures Trading Commission (CFTC) to clear fully collateralized swaps, enabling parent company Bitnomial to introduce prediction markets and provide clearing services to third-party platforms.

According to Friday’s announcement, Bitnomial’s new event contracts will reference crypto and macroeconomic outcomes alongside the firm’s existing Bitcoin (BTC) and crypto derivatives lineup. The products will allow market participants to take positions on results such as token price thresholds and economic indicators.

Headquartered in Chicago, Bitnomial’s exchange and clearing operations offer perpetuals, futures, options, and leveraged spot trading. The clearinghouse supports crypto-based margining and settlement, permitting approved products to be margined and settled directly in digital assets.

Bitnomial president Michael Dunn said the authorization enables the firm to support both its own exchange and external partners, with the goal of building a clearing network that bolsters the broader prediction market infrastructure.

Bitnomial Clearinghouse functions as an infrastructure-only provider rather than a retail-facing venue, giving approved partners access to its margin and settlement systems and allowing collateral to be converted between U.S. dollars and cryptocurrency.

The decision follows a recent approval to launch a CFTC-regulated spot cryptocurrency trading platform in the United States, permitting customers to buy, sell, and trade leveraged and non-leveraged crypto products on a federally supervised exchange.

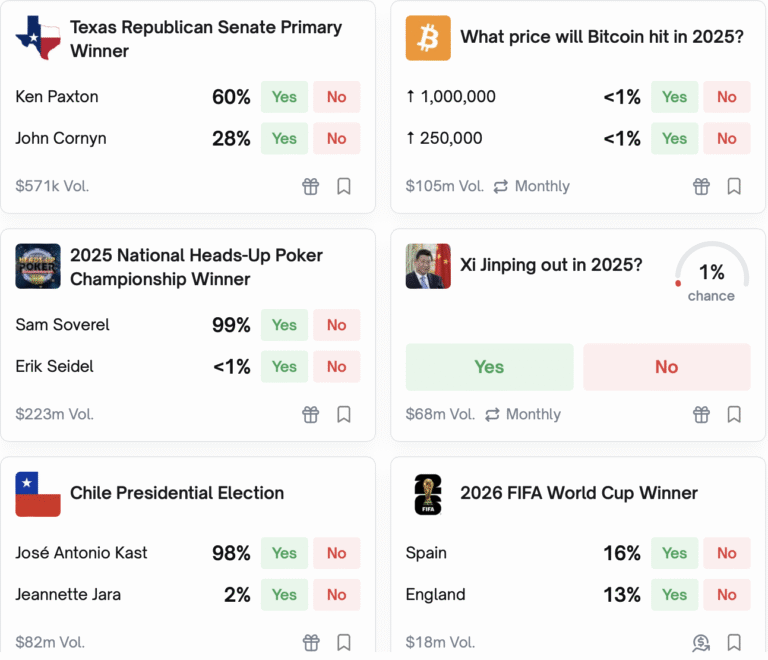

Event contracts on Polymarket. Source: Polymarket

Polymarket gains momentum in the US

Prediction markets have grown rapidly in 2025. Data from DefiLlama shows Kalshi recorded $5.27 billion in trading volume over the past 30 days, while blockchain-based Polymarket processed just under $2 billion in the same period.

In November, Polymarket received CFTC approval to operate an intermediated trading platform, providing access through registered brokers under U.S. market rules.

The approval followed the July closure of a joint investigation by the CFTC and U.S. Department of Justice into whether Polymarket permitted U.S. user trading, which included an FBI search of founder Shayne Coplan’s residence.

Polymarket settles contracts on the Polygon blockchain using the USDC (USDC) stablecoin and has announced multiple partnerships in recent months, including with the UFC and Zuffa boxing, as well as fantasy sports operator PrizePicks in November.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.