Bittensor’s First TAO Halving Marks Network Maturation Milestone

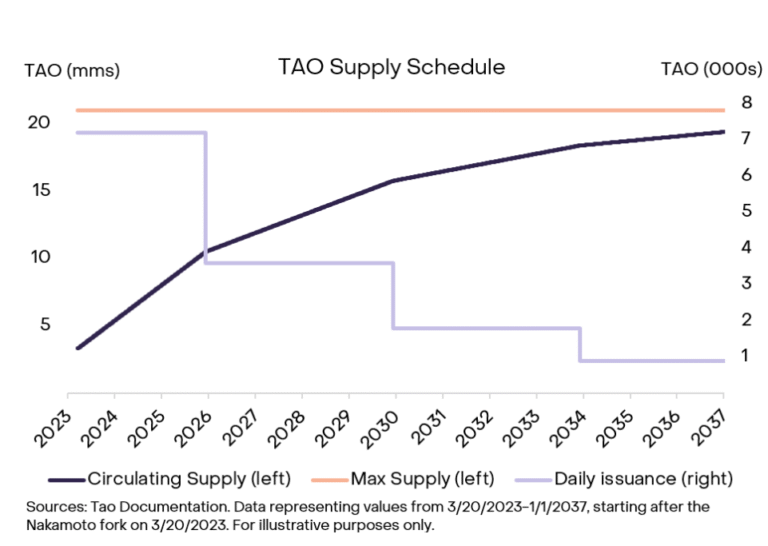

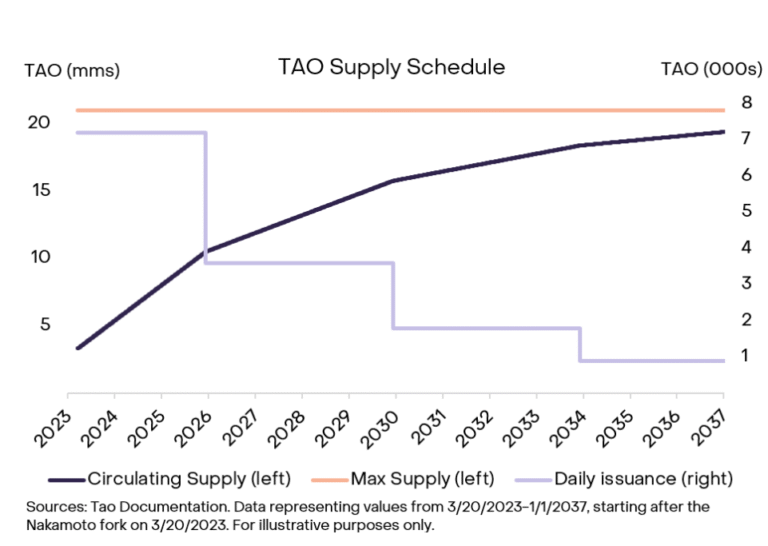

Bittensor’s first token halving is expected on or around Dec. 14, cutting daily issuance of TAO (TAO) to 3,600 from 7,200 as the AI-focused network follows a Bitcoin-style fixed-supply model. More on this can be found in a report from Grayscale Research.

Launched in 2021, the decentralized, open-source machine-learning protocol is built around specialized “subnets” that coordinate marketplaces for AI services. Grayscale Research analyst William Ogden Moore described the upcoming halving as a key step in the network’s development toward its 21 million token supply cap, mirroring Bitcoin’s (BTC) limit.

Hard-capped issuance is often viewed by digital-asset investors and network participants as a potential value driver: if network adoption expands and token demand increases, a finite supply can be more attractive than pre-mined tokens or currencies with unlimited issuance.

Overview of Bittensor subnets

Grayscale characterizes Bittensor’s subnets as a “Y Combinator for decentralized AI networks,” with each subnet operating like a startup focused on a specific product or service. More detailed discussion can be found at CoinGecko.

CoinGecko lists over 100 Bittensor subnets with a combined market capitalization exceeding $850 million. Taostats, which tracks the ecosystem more comprehensively, reports 129 subnets with a total market cap of roughly $3 billion.

According to Grayscale Research, subnet valuations have risen markedly since launch. Among the largest are Chutes, which offers serverless compute for AI models, and Ridges, a subnet dedicated to crowdsourcing the creation of AI agents. The expansion reflects rising demand for decentralized AI infrastructure as developers build and scale new AI applications.

Bittensor subnets have also attracted venture investment. Inference Labs recently raised $6.3 million to advance Subnet 2, a Bittensor marketplace for inference verification. Separately, xTao, an infrastructure developer for the Bittensor ecosystem, began trading on the TSX Venture Exchange in July after going public.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.