BPCE in-app crypto, Coinbase eyes BTC rally, Western Union card

Key developments in digital assets today include BPCE preparing in-app trading of BTC, ETH, SOL and USDC for retail customers, Coinbase Institutional signaling a potential year-end rebound for Bitcoin, and Western Union detailing plans for a “stable card” targeting high-inflation markets.

BPCE to introduce crypto trading in mobile apps: report

French banking group BPCE is set to offer cryptocurrency trading to millions of its retail clients, positioning it among the first large European banks to provide direct access to digital assets. According to a report by The Big Whale, users will be able to buy and sell Bitcoin (BTC), Ether (ETH), Solana (SOL) and USDC (USDC) within the Banque Populaire and Caisse d’Épargne mobile applications starting Monday.

The initial phase will cover customers of four regional banks, including Banque Populaire Île-de-France and Caisse d’Épargne Provence-Alpes-Côte d’Azur, reaching approximately 2 million users. BPCE intends to expand the service across its remaining 25 regional entities through 2026, with the goal of making crypto trading available to its entire retail base of about 12 million clients.

A bank source cited by The Big Whale said the staged rollout is designed to assess performance at launch before broader deployment.

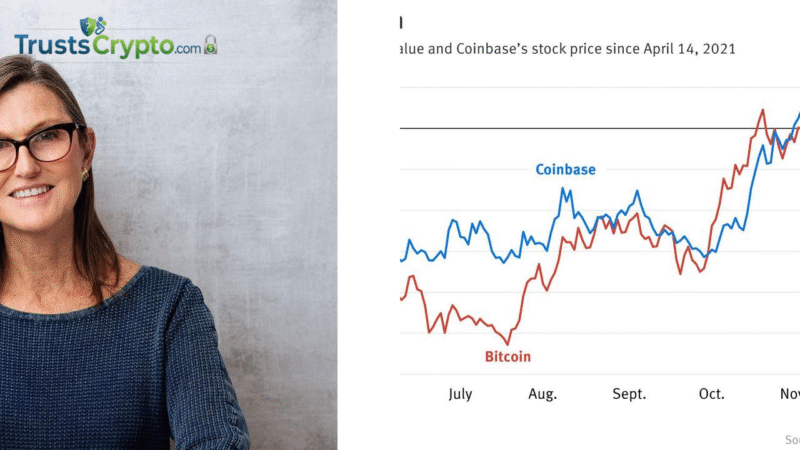

Coinbase Institutional sees potential year-end Bitcoin rally

Coinbase Institutional projects that Bitcoin and the wider crypto market could rally into year-end, citing an expansion in global M2 money supply and expectations for US Federal Reserve rate cuts.

“We think crypto could be poised for a December recovery as liquidity improves, Fed cut odds jump to 92% (as of Dec 4), and macro tailwinds build,” the team wrote in a recent report.

The firm previously anticipated “weakness” in October tied to money supply dynamics and now expects a “December reversal.”

Seasonal trends could also support the move, as risk assets have historically shown strength during the holiday period often referred to as the “Santa Claus rally.”

Western Union plans ‘stable card’ aimed at high-inflation markets

Western Union outlined plans to launch a “stable card” intended to help users in high-inflation economies as part of its broader stablecoin-focused strategy.

Speaking at the UBS Global Technology and AI conference, chief financial officer Matthew Cagwin said the initiative builds on the company’s investor-day announcement that it is expanding beyond traditional cross-border payments into a multi-pronged digital asset roadmap.

Cagwin highlighted Argentina, where annual inflation has recently reached 250–300%, noting that remittances can lose close to half their value within a month. “Imagine a world where your family in the US is sending you $500 home, but by the time you spend it in the next month, it’s only worth $300,” he said.

“We can see a good utility for our stable card there, which is an increment to our prepaid card we have today here in the US,” he added.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.