BTC price Soars to New Heights, Overtakes Google in Market Cap

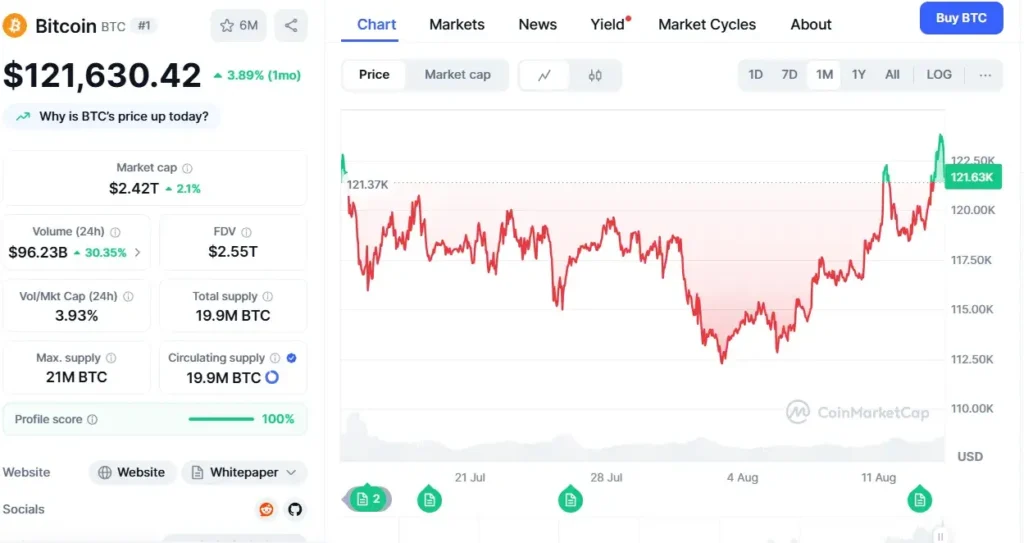

BTC price has once again demonstrated its remarkable resilience and growth potential, surging past its previous all-time high and comfortably exceeding the $124,000 mark. This significant milestone comes as the cryptocurrency mirrors a broader rally observed in the U.S. equities markets, suggesting a growing correlation with traditional financial assets and increasing mainstream acceptance. The sheer momentum of this upward trajectory has propelled Bitcoin to a new level of prominence, solidifying its position as a major global asset.

The recent price surge has had a profound impact on Bitcoin’s market capitalization. In a landmark achievement, Bitcoin has now become the fifth-largest asset in the world by market capitalization, effectively overtaking the tech giant Google and its $2.4 trillion valuation. This monumental feat underscores the increasing investor confidence in Bitcoin’s long-term value proposition and its growing influence within the global financial landscape. Surpassing a company of Google’s stature is a testament to the transformative power and disruptive potential of decentralized digital currencies.

Factors Fueling the Bitcoin Price Rally

Several factors are likely contributing to the current bullish momentum driving the BTC price upwards.

- Correlation with U.S. Equities: The observed mirroring of the rally in U.S. equities suggests that broader macroeconomic sentiment and investor risk appetite are playing a significant role. Positive economic data, coupled with potentially dovish signals from central banks regarding future monetary policy, can create a favorable environment for both stocks and risk-on assets like Bitcoin. This interconnectedness highlights Bitcoin’s evolving role as part of the wider financial ecosystem.

- Increased Institutional Adoption: Growing acceptance and adoption by institutional investors continue to be a major tailwind for Bitcoin. Large corporations adding Bitcoin to their balance sheets, coupled with the launch and increasing popularity of Bitcoin exchange-traded funds (ETFs), provide greater accessibility and legitimacy to the asset class. These institutional flows represent significant capital entering the Bitcoin market, naturally pushing the BTC price higher.

- Limited Supply and Increasing Demand: Bitcoin’s inherent scarcity, with its capped supply of 21 million coins, remains a fundamental driver of its value. As demand continues to increase from both retail and institutional investors, this limited supply creates a natural upward pressure on the BTC price. The simple economics of supply and demand continue to play a crucial role in Bitcoin’s long-term appreciation.

- Positive Market Sentiment: The breakthrough of the previous all-time high often acts as a self-fulfilling prophecy, generating further excitement and FOMO (fear of missing out) among investors. Positive news coverage, analyst upgrades, and social media buzz can amplify this sentiment, attracting new buyers and further fueling the rally of the BTC price.

Analysts Eye Further Upside: $135,000 – $138,000 Targets

Following this significant breakout, market analysts are actively assessing the next potential price targets for Bitcoin. Several prominent voices in the cryptocurrency space are now focusing on the $135,000 to $138,000 range as the next area of potential resistance and profit-taking. These targets are often derived from various technical analysis techniques, including Fibonacci extensions and historical price patterns.

- Technical Indicators Point to Strength: Many technical indicators continue to flash bullish signals, suggesting that the current momentum could indeed carry Bitcoin towards these higher price levels. Moving averages, relative strength indexes (RSI), and other momentum oscillators are indicating strong buying pressure and a lack of significant overhead resistance in the immediate term.

- Potential for Consolidation: While the bullish outlook remains strong, analysts also caution that periods of consolidation are natural after such significant price surges. Bitcoin may experience some sideways trading or minor pullbacks as the market digests the recent gains and looks for the next catalyst for further upward movement of the BTC price.

Implications of Bitcoin’s Record-Breaking Rally

The recent surge in the BTC price and its rise in the global asset rankings have several important implications for the cryptocurrency market and the broader financial world.

- Increased Mainstream Recognition: Bitcoin’s achievement of becoming a top-five global asset further solidifies its position as a legitimate and significant asset class in the eyes of traditional investors, financial institutions, and the general public. This increased recognition can lead to greater adoption and integration of Bitcoin into mainstream financial systems.

- Impact on Altcoins: Bitcoin’s price action often has a significant impact on the broader cryptocurrency market, including altcoins. A strong Bitcoin rally can create a bullish environment for other digital assets, although some may experience greater volatility or divergent price movements.

- Regulatory Scrutiny: As Bitcoin’s market capitalization grows and its influence increases, regulatory bodies around the world are likely to pay even closer attention to the cryptocurrency market. This could lead to further regulatory developments and potentially greater clarity on the legal and operational frameworks for Bitcoin and other digital assets.

Stay informed, read the latest news right now!

Conclusion

Bitcoin’s recent record-breaking rally, which has propelled its price past $124,000 and its market capitalization to overtake Google, marks another significant chapter in the cryptocurrency’s history. Fueled by factors such as correlation with equities, increasing institutional adoption, limited supply, and positive market sentiment, the BTC price continues to exhibit strong bullish momentum. Analysts are now eyeing the $135,000-$138,000 range as the next potential targets. As Bitcoin gains further mainstream recognition and its influence on the global financial landscape grows, the world will be watching closely to see if this remarkable rally has further to run.