Circle and Aleo develop USDCx, a privacy-focused stablecoin

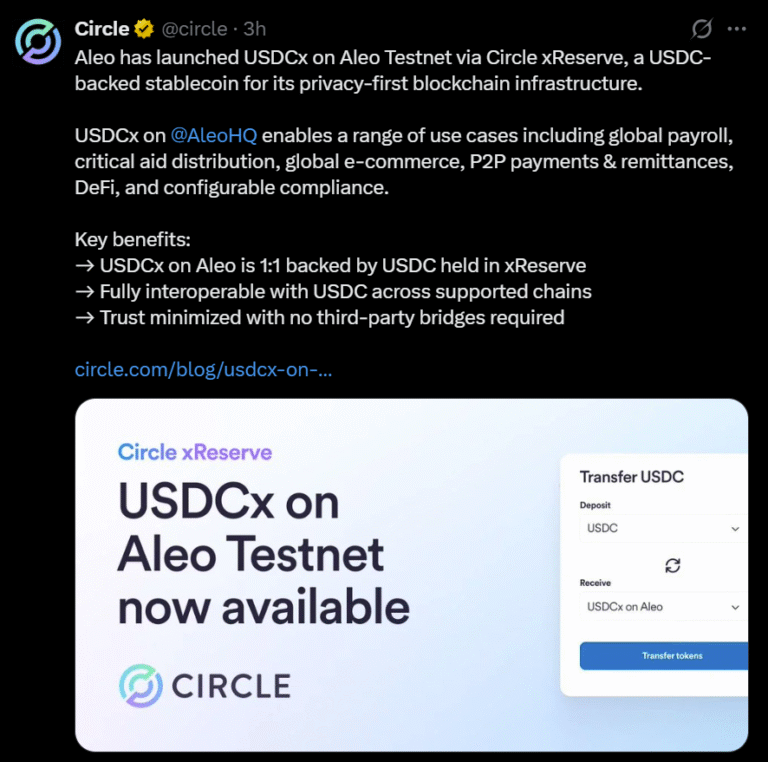

Circle is developing a privacy-enhanced version of its US dollar–pegged USDC token in collaboration with Aleo, aiming to support institutional adoption by offering greater confidentiality than public blockchains typically provide. The initiative, called USDCx and geared toward banking and enterprise users, was reported by Fortune on Tuesday, citing Aleo co-founder Howard Wu.

Unlike most stablecoins, where wallet addresses and transaction details are publicly viewable onchain, USDCx is intended to deliver “banking-level privacy.” Circle would retain the ability to supply a compliance record if law enforcement or regulators request information on particular transactions, according to the report.

The project seeks to overcome a key barrier for large financial institutions that have hesitated to use blockchain-based payment rails due to the public visibility of transaction flows.

Aleo has maintained that privacy is critical for the next stage of stablecoin adoption. In a May post, the company stated that while transparency is often cited as a core blockchain benefit, “it becomes a liability when dealing with sensitive, confidential payment data.”

Other firms are also advancing privacy features for stablecoins. Digital asset infrastructure provider Taurus has built a private smart-contract system for stablecoins designed to enable anonymous transactions, with the goal of facilitating intracompany payments and employee payrolls.

Circle’s push into privacy-focused stable assets comes as more institutions examine stablecoins following the US GENIUS Act, a new regulatory framework for US dollar–pegged tokens.

A corporate stablecoin race has begun in the wake of the GENIUS Act. Citigroup has partnered with Coinbase to test stablecoin-based payment rails for clients, and other Wall Street firms, including JPMorgan and Bank of America, are reportedly in early-stage experiments with similar technologies.

Global remittance provider Western Union is developing a digital asset settlement system on Solana, with plans to introduce a US Dollar Payment Token as part of a broader infrastructure upgrade. Visa has also expanded its stablecoin offerings amid intensifying competition.

Average stablecoin supply by issuer. Source: Visa Onchain Analytics

The US dollar underpins the majority of activity in the stablecoin market. USDC (USDC) and Tether’s USDt (USDT) together represent roughly 85% of the market, while other dollar-linked tokens, including synthetic dollars and PayPal USD (PYUSD), are also among the largest.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.