Crypto Sell-Off Hits Treasuries, ETFs and Mining Output

Written by Sam Bourgi, Staff Writer — Reviewed by Sam Bourgi, Staff Writer

Crypto’s stress test hits balance sheets as Bitcoin, Ether collapse

40 minutes ago

Listen 0:00

Newsletter in your social feed

Subscribe on Subscribe on

The latest cryptocurrency sell-off is affecting corporate treasuries, spot exchange-traded funds (ETFs) and infrastructure usage, illustrating how price volatility filters into financial statements and operations.

This week, Ether’s (ETH) decline is generating sizable unrealized losses for companies with large token holdings, while Bitcoin (BTC) ETF investors are experiencing their first broad drawdown since launch.

Separately, severe weather conditions are showing that mining activity remains tied to power grid stability, and a former crypto miner turned AI infrastructure firm underscores how prior-generation mining assets are being redeployed for artificial intelligence workloads.

This week’s Crypto Biz coverage examines BitMine Immersion Technologies’ expanding paper losses, BlackRock’s Bitcoin ETF investors slipping into negative territory and the effect of a U.S. winter storm on publicly listed miners.

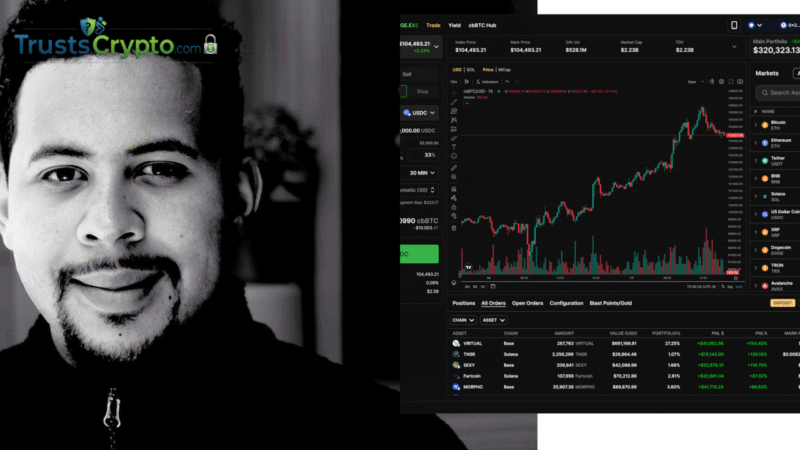

BitMine’s ETH unrealized losses deepen

BitMine Immersion Technologies, chaired by Tom Lee, is facing increased paper losses on its Ether-weighted treasury after ETH fell below $2,200 during the recent market downturn.

The move pushed the company’s unrealized losses beyond $7 billion, highlighting the risks of balance sheets concentrated in volatile digital assets.

BitMine holds approximately $9.1 billion in Ether, including a recent acquisition of 40,302 ETH, leaving the company highly sensitive to further price moves. This acquisition was part of the company’s ETH strategy.

While these losses remain unrealized unless assets are sold, they point to the vulnerability of crypto treasury approaches during market declines. Lee has said unrealized losses are part of ETH-focused strategies and that the company is intended to mirror ETH price behavior, making weakness during a downturn unsurprising.

Source: Dropslab

BlackRock Bitcoin ETF investors move underwater

As Bitcoin dropped below $80,000, aggregate investor returns in BlackRock’s iShares Bitcoin Trust (IBIT) turned negative, reflecting the severity of the recent pullback and its impact on portfolios.

According to Bob Elliott, chief investment officer at Unlimited Funds, the average dollar invested in IBIT is now underwater. Bitcoin later extended losses below $75,000, further pressuring performance.

IBIT was among BlackRock’s most successful ETF launches, becoming the firm’s fastest product to accumulate $70 billion in assets. Those investors are now encountering Bitcoin’s downside volatility.

Source: Bob Elliott

U.S. winter storm hits Bitcoin mining output

A powerful winter storm across the United States in late January prompted Bitcoin miners to significantly reduce production, underscoring mining’s sensitivity to grid stress during extreme weather.

New data from CryptoQuant indicates that daily output from publicly listed miners averaged roughly 70 to 90 BTC prior to the storm, then fell to about 30 to 40 BTC at the peak of the disruption. The decline was swift, reflecting widespread curtailments as miners reduced load or temporarily went offline to ease pressure on local power systems.

Production began to recover as conditions improved, illustrating the operational flexibility of U.S. miners but also the variability introduced by grid-dependent operations.

The CryptoQuant dataset covers publicly traded miners such as CleanSpark, MARA Holdings, Bitfarms and Iris Energy, offering a snapshot of how large-scale U.S. operations respond when power availability tightens.

Source: Julio Moreno

CoreWeave highlights crypto-to-AI infrastructure pivot

CoreWeave’s shift from cryptocurrency mining to AI infrastructure illustrates how mining-era hardware is being repurposed for the AI expansion, showing how compute resources transition across technology cycles.

According to The Miner Mag, Ethereum’s migration from proof-of-work to proof-of-stake sharply reduced demand for GPU-based mining, prompting CoreWeave and similar firms to pivot to AI and high-performance computing.

Although CoreWeave no longer operates as a crypto-focused company, its transition has become a reference point for miners exploring diversification, including HIVE Digital, Hut 8 and MARA Holdings.

CoreWeave’s strategy gained added visibility after Nvidia agreed to a $2 billion equity investment, reinforcing the view that infrastructure originally built for crypto mining is now supporting a significant layer of AI data center capacity.

Crypto Biz is a weekly update on the business of blockchain and digital assets, delivered every Thursday.

This article adheres to an independent, transparent editorial policy and aims to provide accurate, timely information. Readers are encouraged to verify information independently. Editorial policy: https://cointelegraph.com/editorial-policy

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.