Danske Bank opens Bitcoin, Ether ETPs; tokenized gold tops $6B

Danske Bank opened access to Bitcoin and Ether exchange-traded products (ETPs) for select customers, the market value of tokenized commodities surpassed $6 billion amid gold-led gains, and the Bank of England launched an industry testbed for synchronized settlement of tokenized assets in British pounds.

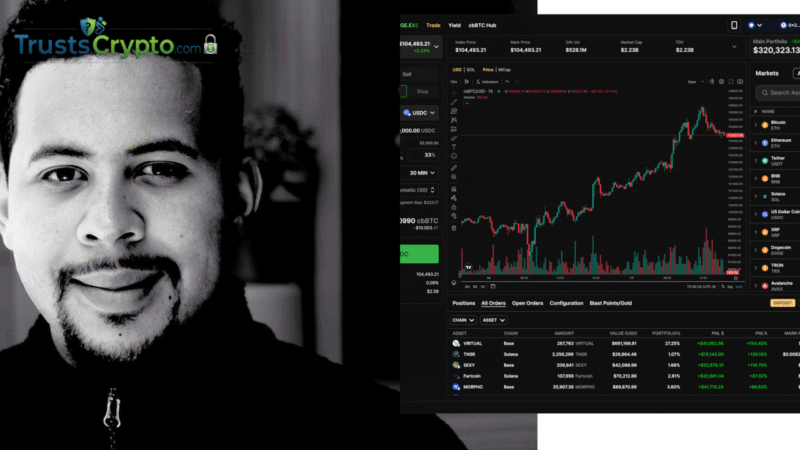

Danske Bank enables client access to Bitcoin and Ether ETPs

Danske Bank, Denmark’s largest lender and a major retail bank in Northern Europe with over five million customers, will allow clients to purchase Bitcoin and Ether ETPs from BlackRock and WisdomTree via its eBanking and Mobile Banking platforms for the first time. The service, announced Wednesday, is available to self-directed investors only—customers trading on the bank’s platform without investment advice—and follows “increasing customer demand” and “improved regulation” under the European Union’s Markets in Crypto-Assets (MiCA) framework.

At launch, customers can access three “carefully selected” products—two tracking Bitcoin (BTC) and one tracking Ether (ETH). The ETPs, from BlackRock and WisdomTree, fall under Markets in Financial Instruments Directive II (MiFID II) rules governing investor protection and cost transparency. According to the bank, the structure offers advantages versus holding coins directly, including straightforward trading and institutional-grade custody.

Kerstin Lysholm, head of investment products and offerings at Danske Bank, said cryptocurrencies have become more established as an asset class, leading to a growing number of customer inquiries about adding them to portfolios. She noted that clearer regulation has “generally increased confidence in cryptocurrencies,” and the bank now considers “the time is ripe” to make such products available to clients who understand the “very high risks” involved.

Danske Bank pivots. Source: Danske Bank

Tokenized commodities surpass $6 billion as gold-led growth accelerates

The market for tokenized commodities expanded 53% in less than six weeks to more than $6.1 billion, making it the fastest-growing segment of real-world asset tokenization as additional gold is issued onchain.

The sector was valued at just over $4 billion at the start of the year, adding roughly $2 billion since Jan. 1, according to data from Token Terminal. The category is largely dominated by gold-backed products.

Tether Gold (XAUt) drove most of the increase, with its market capitalization up 51.6% over the past month to $3.6 billion. PAX Gold (PAXG) rose 33.2% in the same period to $2.3 billion. Overall, tokenized commodities climbed 360% year-on-year, with growth since the start of 2026 outpacing increases in tokenized stocks and tokenized funds at 42% and 3.6%, respectively.

Change in market cap for tokenized commodities since 2018. Source: Token Terminal

Bank of England to pilot synchronized sterling settlement for tokenized assets

The Bank of England launched an industry experimentation program to assess how tokenized assets could be settled using synchronized, atomic settlement in pounds sterling as part of the modernization of the UK’s real-time gross settlement (RTGS) platform.

Under the Synchronisation Lab initiative, 18 selected firms will test delivery-versus-payment and payment-versus-payment processes linking the BoE’s next-generation RTGS core ledger, RT2, with external distributed-ledger platforms. The tests will run in a non-live environment without real money, according to the bank.

The six-month pilot, slated to begin in spring 2026, aims to validate the central bank’s design choices for synchronized settlement, evaluate interoperability between central bank money and tokenized assets, and guide development of a potential live RTGS synchronization capability. First announced in October, the program brings together market infrastructure providers, banks, fintechs, and decentralized-technology firms to explore use cases including tokenized securities settlement, collateral optimisation, foreign exchange, and digital-money issuance.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.