DeFi Weekly: Bitcoin dips, TRM Labs $1B, Step Finance breach

Cryptocurrency markets fell sharply this week amid concerns about slowing U.S. liquidity after U.S. President Donald Trump nominated Kevin Warsh to chair the Federal Reserve. Bitcoin exchange-traded funds (ETFs) posted three straight days of net outflows, including $431 million on Thursday, according to Farside Investors. Bitcoin (BTC) briefly declined to $60,074 on Friday before rebounding to above $64,930 as of 7:49 a.m. UTC.

Warsh, a former Federal Reserve governor from 2006 to 2011, is anticipated to continue the interest rate cut trajectory. His nomination may also indicate that broader market liquidity is likely to “stabilize rather than meaningfully expand,” said Thomas Perfumo, an economist at crypto exchange Kraken.

Derivatives markets saw the 10th-largest liquidation day on record on Jan. 31, with more than $2.56 billion in leveraged positions closed, data from derivatives platform CoinGlass shows.

Top 10 largest liquidation events in crypto history. Source: Coinglass

TRM Labs raises $70M at $1B valuation, joining crypto unicorn ranks

Blockchain intelligence firm TRM Labs closed a $70 million Series C round at a $1 billion valuation, becoming the latest crypto company to reach unicorn status. The round was led by early backer Blockchain Capital, with participation from Goldman Sachs, Bessemer Venture Partners, Brevan Howard Digital, Thoma Bravo, Citi Ventures and Galaxy Ventures, according to a Wednesday announcement.

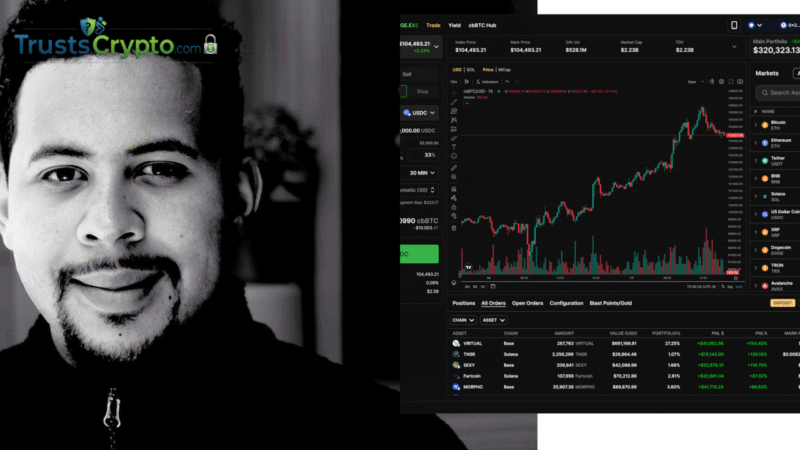

TRM Labs develops AI-driven tools for public and private institutions to combat cybercrime, targeting illicit activity increasingly augmented by automation. “At TRM, we’re building AI for problems that have real consequences for public safety, financial integrity, and national security,” said Esteban Castaño, TRM Labs’ co-founder and CEO. “This funding allows our world-class team — and the people who will join us next — to innovate alongside institutions on the front lines of the most consequential threats, and expand the potential of AI to meaningfully improve how our critical systems are protected.”

Avalanche RWA tokenization hits Q4 high as BlackRock’s BUIDL grows onchain

Institutional activity in tokenized money market funds, loans and indexes increased on Avalanche in the fourth quarter, lifting the value of real-world assets (RWAs) on the network to a new peak. The total value locked (TVL) in tokenized RWAs on Avalanche rose 68.6% over the fourth quarter of 2025 and nearly 950% year over year to more than $1.3 billion, supported by the $500 million BlackRock USD Institutional Digital Liquidity Fund (BUIDL) launched in November, Messari research analyst Youssef Haidar said in a Jan. 29 report.

Fortune 500 fintech FIS partnered with Avalanche-based marketplace Intain to launch tokenized loans in November, contributing to the increase in TVL, Haidar said. Intain enables 2,000 U.S. banks to securitize more than $6 billion in loans on Avalanche. S&P Dow Jones also partnered with Dinari, a blockchain powered by Avalanche, to introduce the S&P Digital Markets 50 Index, which tracks 35 crypto-linked equities and 15 crypto tokens on the network.

Change in Avalanche real-world asset tokenization over the last 12 months. Source: Messari

ParaFi Capital invests $35M in Solana-based Jupiter

Solana-based onchain trading and liquidity aggregator Jupiter secured a $35 million strategic investment from ParaFi Capital, marking the protocol’s first external funding after years of bootstrapped growth. The transaction consisted of token purchases at prevailing market prices with no discount, included an extended lockup, and was settled entirely in Jupiter’s JupUSD stablecoin, the companies said. Financial terms beyond the $35 million investment were not disclosed.

The investment follows a period in which Jupiter processed more than $1 trillion in trading volume over the past year and expanded beyond swap routing into perpetuals, lending and stablecoins, according to the company. The deal also included warrants that permit ParaFi Capital to buy additional tokens at higher prices, a structure intended to reflect long-term alignment.

In October, Jupiter launched a beta onchain prediction market developed with Kalshi, followed in January by the debut of JupUSD, a Solana-native, dollar-pegged stablecoin built with Ethena Labs. Jupiter’s native token (JUP) rose about 9% over the past 24 hours, according to CoinGecko.

Source: Jupiter

Source: CoinGecko

Aave retires Avara brand, phases out Family wallet to concentrate on DeFi

Aave Labs said it is discontinuing its “umbrella brand” Avara as part of a broader effort to refocus on decentralized finance and streamline branding. Aave founder and CEO Stani Kulechov posted on X Tuesday that Avara — which included the Family crypto wallet and previously the Lens social media platform — “is no longer required as we go all in on bringing Aave to the masses.”

Kulechov added that the Apple iOS-based Family wallet is being wound down, noting the team “learned that onboarding millions of users requires purpose-built experiences, such as savings, rather than generic, open-ended wallet experiences.”

The change follows last month’s transfer of Lens stewardship to the Mask Network, with Kulechov saying Aave’s role in Lens would shift to an advisory capacity to prioritize DeFi initiatives.

Source: Stani Kulechov

Step Finance treasury wallets breached; about $27M in SOL drained, STEP plunges 90%

Step Finance, a decentralized finance portfolio tracker on Solana, reported a security incident that compromised multiple treasury wallets, prompting a steep decline in its native token. “Earlier today, several of our treasury wallets were compromised by a sophisticated actor during APAC hours. This was an attack facilitated through a well-known attack vector,” the platform stated on X, adding that remediation steps have been taken.

Onchain data reviewed by blockchain security firm CertiK indicates that roughly 261,854 Solana (SOL), valued at about $27.2 million, was unstaked and moved from wallets controlled by Step Finance. The team has not yet confirmed the total scale of losses, the method of compromise, or whether the issue stemmed from a smart contract vulnerability, compromised keys, or an internal access breach. It remains unclear whether any user funds were affected beyond protocol-owned assets.

The compromised transaction. Source: Certik

DeFi market overview

According to market data from TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week lower. Privacy-focused Zcash (ZEC) declined 35% to post the largest weekly drop among the top 100, followed by Story (IP), down 34% over the same period.

Total value locked in DeFi. Source: DefiLlama

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.