ETH Futures Top Bitcoin on CME as Super-Cycle Debate Grows

Ether futures trading on CME Group has surpassed activity in Bitcoin contracts, a shift that coincides with elevated volatility in Ether (ETH) options and has revived discussion of a potential “super-cycle” in the asset. The development comes amid a broader pullback in digital assets.

In a recent CME video, Priyanka Jain, director of equity and crypto products, noted that Ether (ETH) options are displaying higher volatility than Bitcoin (BTC) options. She said the increased price swings have drawn more participants and accelerated growth in CME’s Ether futures. Jain also questioned whether the momentum reflects the start of a long-term super-cycle or a short-term catch-up driven by volatility.

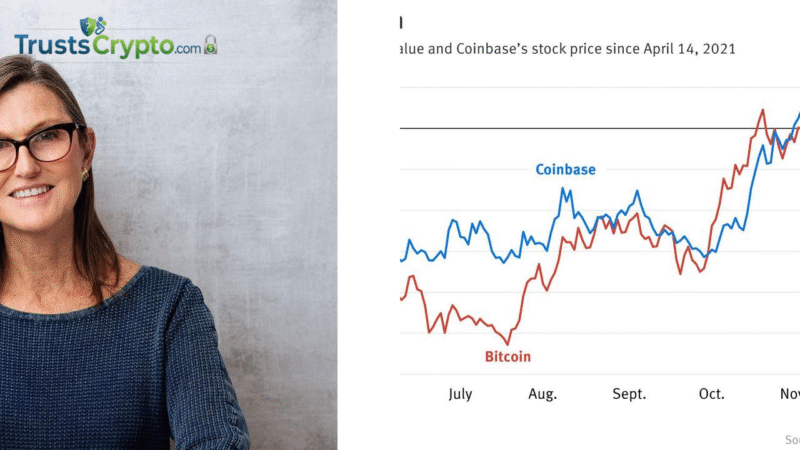

The rotation became most evident in July, when open interest in Ether futures on the exchange exceeded that of Bitcoin futures for the first time.

Jain added that, measured by U.S. dollar notional value, Bitcoin and Micro Bitcoin futures still account for the largest share of activity, but participation in Ether-linked products is expanding steadily.

ETH price volatility returns

Ether, Bitcoin and the wider crypto market faced renewed selling on Monday, extending a volatile stretch that capped a challenging month for the sector. The move followed what appeared to be coordinated de-risking into the end of November.

Market analyst CTO Larsson said traders reduced exposure immediately after the monthly close at 00:00 UTC due to a weak-looking candle formation.

Separately, Ether treasury companies — firms that hold ETH on their balance sheets — have seen the value of those positions fall. Data from CoinGecko indicate that companies including SharpLink and Bit Digital are currently underwater on their ETH allocations.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.