Figure Files Second IPO to Issue Native Equity on Solana

Figure Technology has filed for a second public offering to issue blockchain-native equity on Solana, enabling onchain trading and decentralized finance (DeFi) applications. The plan follows the company’s recent listing on Nasdaq and is intended to expand the range of tokenized securities use cases on Solana.

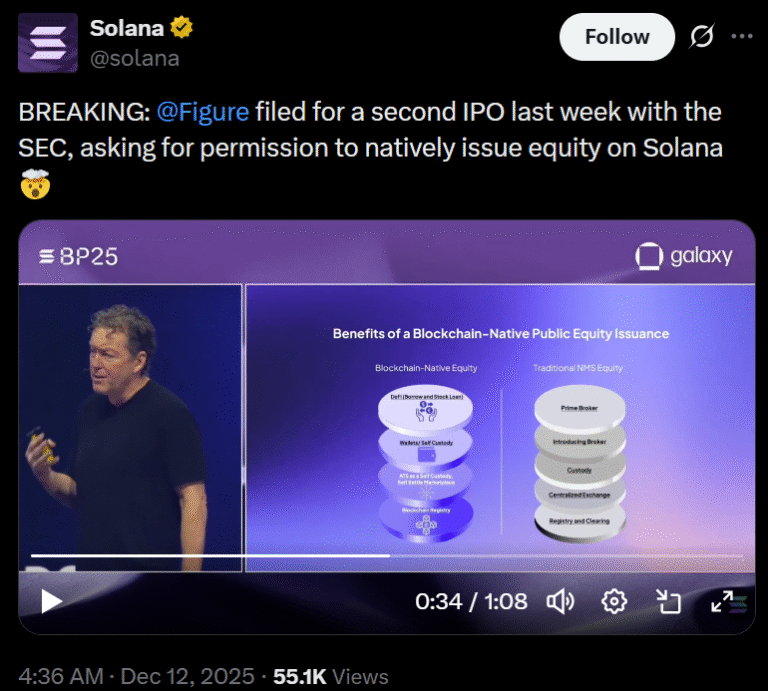

Announced by executive chairman Mike Cagney at the Solana Breakpoint conference, the company submitted a filing to the United States Securities and Exchange Commission (SEC) to offer a new version of Figure equity directly on a public blockchain, specifically Solana.

Cagney said the blockchain-native equity would not trade on traditional venues such as Nasdaq or the New York Stock Exchange and would not rely on introducing brokers or prime brokers, citing platforms like Robinhood and Goldman Sachs as examples. Source: Solana

Instead, the security would be issued and transacted natively onchain through Figure’s alternative trading system, which he described as effectively operating like a decentralized exchange.

According to Cagney, investors would be able to move the tokenized equity into DeFi protocols, where it could be used for borrowing and lending. He added that the company intends to extend the initiative beyond its own shares by supporting native equity issuance for other companies within the Solana ecosystem.

Tokenization activity on Solana is accelerating

Solana, one of the most active public blockchains, has been gaining traction as a venue for tokenized assets, with its share of the real-world asset (RWA) market growing over the past year.

While Ethereum remains the leading network for tokenization today, Solana could become the preferred platform for stablecoins and tokenized assets over time, according to Matt Hougan, chief investment officer at Bitwise.

Hougan said that as traditional finance evaluates long-term tokenization strategies, attention is likely to focus on networks offering high throughput, speed and rapid finality — areas where Solana holds advantages relative to several competitors.

Research from RedStone has identified Solana as a high-performance challenger in the RWA segment, particularly in markets for tokenized U.S. Treasurys.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.