Glassnode: Crypto ETF Outflows Signal Institutional Pullback

Bitcoin and Ether exchange-traded funds have logged a sustained run of net outflows since early November, indicating reduced participation from institutional investors, according to analytics firm Glassnode.

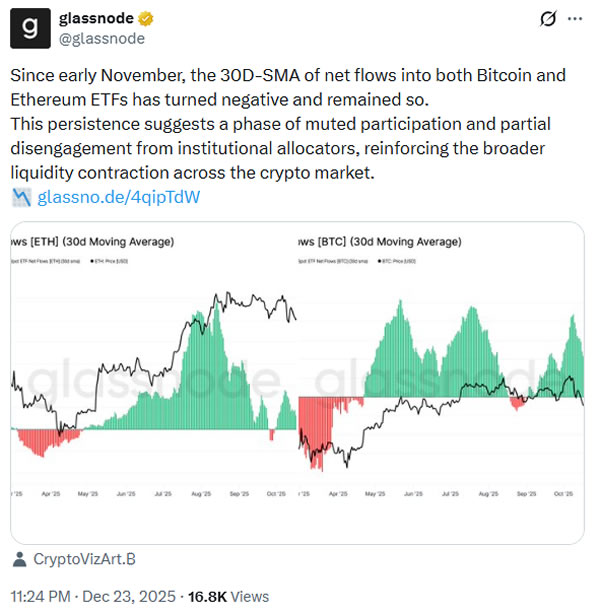

Glassnode said on Tuesday that the 30-day simple moving average of net flows into US spot Bitcoin (BTC) and Ether (ETH) ETFs has turned negative. “This persistence suggests a phase of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction across the crypto market,” it said.

Glassnode noted that ETF flows typically lag spot markets, which have softened since mid-October. The funds are also viewed as an indicator of institutional sentiment, which supported prices for much of the year but has deteriorated alongside the broader market.

ETF selling pressure returns

Coinglass reported aggregate Bitcoin ETF net flows were negative over the past four consecutive trading days. However, BlackRock’s iShares Bitcoin Trust (IBIT) recorded modest inflows over the past week.

“Crypto ETF selling pressure is back,” market newsletter the Kobeissi Letter said on Tuesday, noting that crypto funds saw $952 million in outflows last week. Investors have withdrawn capital in six of the last ten weeks, it added.

Despite recent outflows, the BlackRock fund has amassed $62.5 billion in inflows since inception, eclipsing all rival spot Bitcoin ETFs.

IBIT leads 2025 flows despite negative return

Bloomberg ETF analyst Eric Balchunas said on Saturday that IBIT is the only ETF on Bloomberg’s 2025 Flow Leaderboard with a negative return for the year. “The real takeaway is that it was sixth place despite the negative return,” he said.

Balchunas added that the BlackRock fund attracted more money than the SPDR Gold Shares fund (GLD), which was up 64%. He noted the fund took in roughly $25 billion “in a bad year,” pointing to the potential for larger flows in more favorable conditions.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.