House Democrats press Treasury on World Liberty bank charter

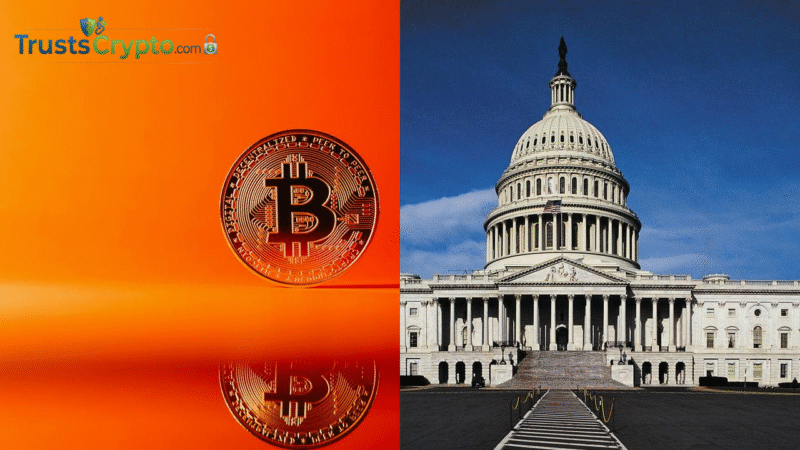

House Democrats have asked Treasury Secretary Scott Bessent to clarify how regulators are evaluating World Liberty Financial’s application for a national trust bank charter to issue a dollar-backed token, citing concerns over systemic risk, foreign ownership, and potential political influence.

In a letter sent Thursday, 41 Democratic members of the House Financial Services Committee led by Representative Gregory Meeks requested details on safeguards to prevent foreign government officials or politically connected investors from leveraging the chartering process to influence the U.S. financial system.

The lawmakers referenced reporting that a senior royal from the United Arab Emirates acquired nearly half of World Liberty Financial for about $500 million, including a reported $187 million paid to Trump-affiliated entities, while the company was seeking a national trust bank charter from the Office of the Comptroller of the Currency (OCC).

They said the intersection of digital asset trust structures, untested liquidity and resolution frameworks, and foreign political interests raises issues regulators “cannot afford to sidestep.”

The letter also questioned whether Executive Order 14215, which Democrats said brought traditionally independent financial regulators under closer White House oversight, could affect the OCC’s independence in assessing World Liberty’s application. The lawmakers asked Bessent to outline the roles of the White House, the Office of Management and Budget, and the Treasury Department in OCC charter determinations and to respond in writing by Thursday.

World Liberty Financial’s public profile

The outreach comes as World Liberty Financial and other Trump-aligned crypto initiatives increase their visibility in Washington and on Wall Street, including at a Wednesday event at Trump’s Mar-a-Lago club attended by executives from both crypto and traditional finance, such as Coinbase CEO Brian Armstrong, Binance co-founder Changpeng Zhao, and Goldman Sachs CEO David Solomon.

Ahead of the event, the WLFI token linked to a Trump family-aligned platform rose 23% as organizers promoted a discussion of World Liberty’s roadmap and its position in the broader digital asset market.

Warren opposes taxpayer support for crypto markets

Separately on Wednesday, Senate Banking Committee Democrat Elizabeth Warren urged Bessent and Federal Reserve Chair Jerome Powell not to use taxpayer-backed measures to stabilize crypto markets. Warren said any bailout of “cryptocurrency billionaires” would create moral hazard and transfer losses from large investors to taxpayers.

Her letter characterized potential rescue actions for major crypto firms and investors as a test of whether policymakers intend to extend bank-style backstops to the digital asset sector as regulators consider new charters and oversight for crypto-related institutions.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.