Hyperliquid vote to sideline $1B Assistance Fund HYPE as burned

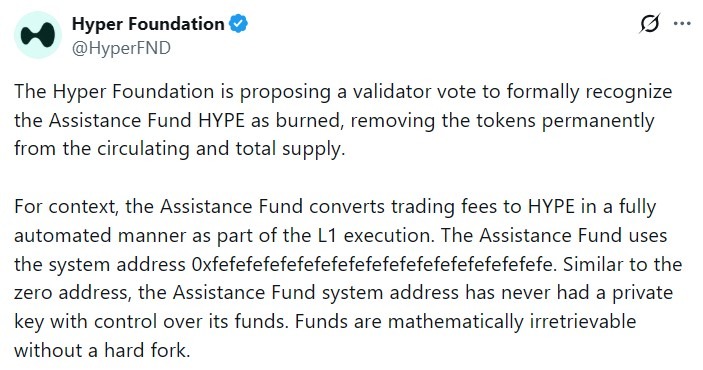

The Hyper Foundation has initiated a validator vote to formally designate HYPE tokens held in the Hyperliquid protocol’s Assistance Fund system address as permanently inaccessible, excluding them from both circulating and total supply calculations.

The foundation described the Assistance Fund as a protocol-level feature embedded in the layer-1 execution environment. It automatically converts trading fees into HYPE and directs them to a designated system address. As of publication, the wallet holds approximately $1 billion in tokens.

The system address was created without control mechanisms, rendering the funds unrecoverable without a hard fork. The foundation said that a “Yes” vote indicates validators agree to treat the Assistance Fund HYPE as effectively burned.

Native Markets, issuer of the Hyperliquid-native stablecoin USDH, noted that 50% of the stablecoin’s reserve yield is sent to the Assistance Fund and converted into HYPE. The company said that, if the vote passes, these contributions would be formally recognized as burned.

Supply treatment amid institutional interest

While the proposal uses the term “burned,” it does not reduce existing supply. Instead, it formalizes how fee-derived tokens are handled for governance and supply metrics, aiming to remove uncertainty around Hyperliquid’s effective supply.

The clarification comes as Hyperliquid’s fee-based model draws greater institutional attention. In a research note on Hyperliquid-focused digital asset treasuries (DATs), Cantor Fitzgerald described the protocol as returning nearly all fee revenue to tokenholders via automated repurchases.

Cantor estimated that Hyperliquid generated about $874 million in fees year-to-date (YTD) as of 2025, with 99% of protocol fees routed through the Assistance Fund to repurchase HYPE.

While Cantor cited the repurchases as a factor in a declining circulating supply, the Hyper Foundation’s proposal specifies that Assistance Fund balances were never intended to be spendable or recoverable. The vote seeks to align reported supply metrics with the protocol’s original design rather than retroactively creating scarcity.

Trading activity and HYPE DAT holdings

Hyperliquid remains among the leading decentralized perpetual exchanges. Over the past 30 days, DefiLlama data shows more than $205 billion in perpetuals trading volume, placing it third among perps DEXs during that period.

A growing set of DAT entities has formed around HYPE. According to Cantor, Hyperion DeFi (HYPD) holds about $46 million in HYPE within its treasury, while Hyperliquid Strategies (PURR) holds approximately $340 million.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.