Inversion CEO: Prediction Markets Spur Churn for Fintech Apps

Inversion Capital founder and CEO Santiago Roel Santos cautioned that the growing push by consumer finance platforms to integrate prediction markets could increase user churn and undermine long-term value, according to a blog post published on Saturday.

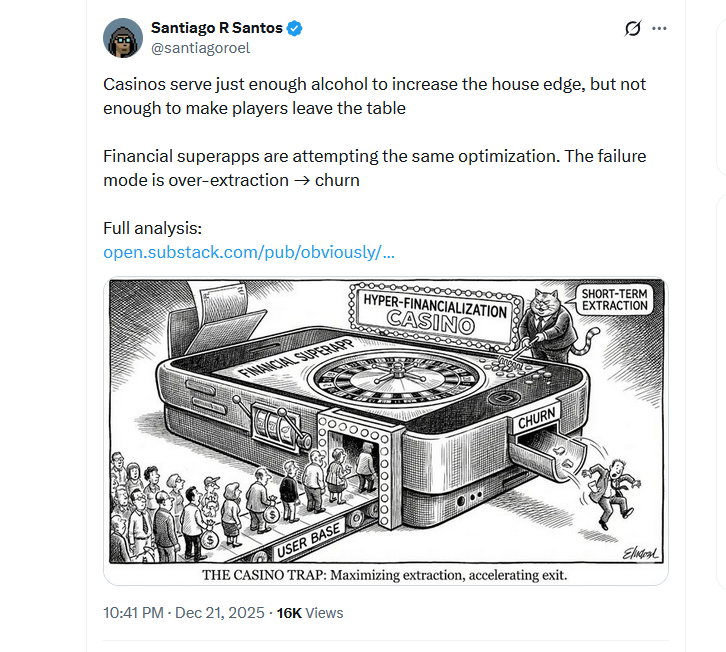

Santos said he supports the concept of prediction markets but warned that adding “casino-like” features to mainstream apps such as Robinhood heightens the risk of account liquidation, leading to higher attrition. He argued that as users spend more time in such products, the probability of losing their balances rises, which can ultimately remove them from the ecosystem. He added that a user who churns delivers no ongoing value to the platform.

Robinhood has intensified its focus on prediction markets over 2025. Adoption of blockchain-based prediction markets also climbed during the 2024 U.S. elections, with Robinhood first entering the space in March through a partnership with Kalshi. On Wednesday, crypto exchange Coinbase said it would add prediction markets as part of its “everything app” initiative, also in collaboration with Kalshi. In a separate development, an affiliate of Gemini obtained a U.S. license to offer event contracts.

Santos argued that emphasizing speculative products risks distracting from the core value proposition of simplified, accessible financial services for retail customers. He said platforms initially succeed by being easier to use than incumbents, and the long-term opportunity is to evolve with customers and serve a broader share of their financial needs rather than attempting to maximize short-term revenue during periods of heightened speculation.

He added that financial “superapps” that treat churn as a key risk are likely to build stronger competitive advantages over time. If he were prioritizing roadmaps, Santos said he would focus on products that align with customers as they mature financially, such as credit cards, insurance, and savings vehicles, describing them as adjacent to managing household liquidity and more durable over the long run.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.