Itaú Asset: Allocate 1–3% to Bitcoin in 2026 for Diversification

Itaú Asset Management, the investment arm of Brazil’s largest private bank, Itaú Unibanco, has advised investors to allocate 1% to 3% of their portfolios to Bitcoin in 2026. In a research note, Renato Eid said that ongoing geopolitical tensions, changing monetary policy, and persistent currency risks strengthen the case for Bitcoin (BTC) as a complementary asset.

Eid described Bitcoin as “an asset distinct from fixed income, traditional stocks, or domestic markets, with its own dynamics, return potential, and — due to its global and decentralized nature — a currency hedging function.”

The recommendation follows a volatile year for Bitcoin. The asset started 2025 near $95,000, declined toward $80,000 during the tariff crisis, rose to a record high of $125,000, and later eased back to around $95,000.

Bitcoin may support portfolio stability during currency fluctuations

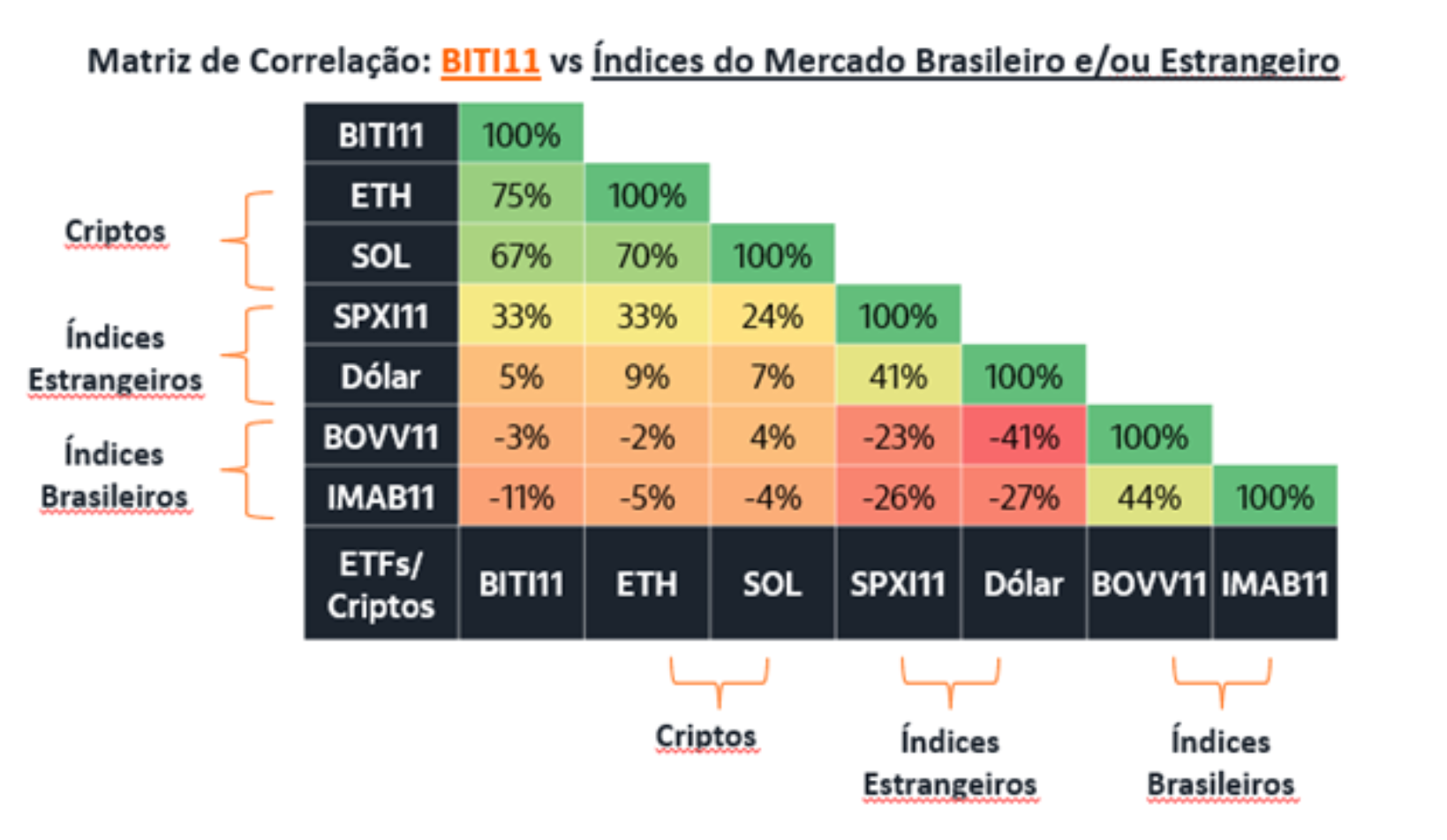

Brazilian investors experienced sharper swings than global participants due to currency moves. The Brazilian real appreciated by about 15% this year, increasing local-market losses for some investors. Eid argued that a small, steady allocation to Bitcoin can help mitigate risks that traditional assets do not hedge. Citing internal data, he noted a low correlation between BITI11, the bank’s locally listed Bitcoin ETF, and other major asset classes, supporting the case for a modest BTC position to enhance portfolio balance.

The bank said that an allocation of around 1% to 3% allows investors to benefit from diversification.

Itaú Asset forms dedicated crypto division

In September, Itaú Asset established a standalone crypto unit and appointed former Hashdex executive João Marco Braga da Cunha to lead it. The unit builds on Itaú’s existing digital-asset offerings, including its Bitcoin ETF and a retirement fund with crypto exposure.

Itaú also plans to expand its product lineup, ranging from fixed-income-style instruments to higher-volatility strategies such as derivatives and staking.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.