JPMorgan’s Dimon denies political debanking, urges rule changes

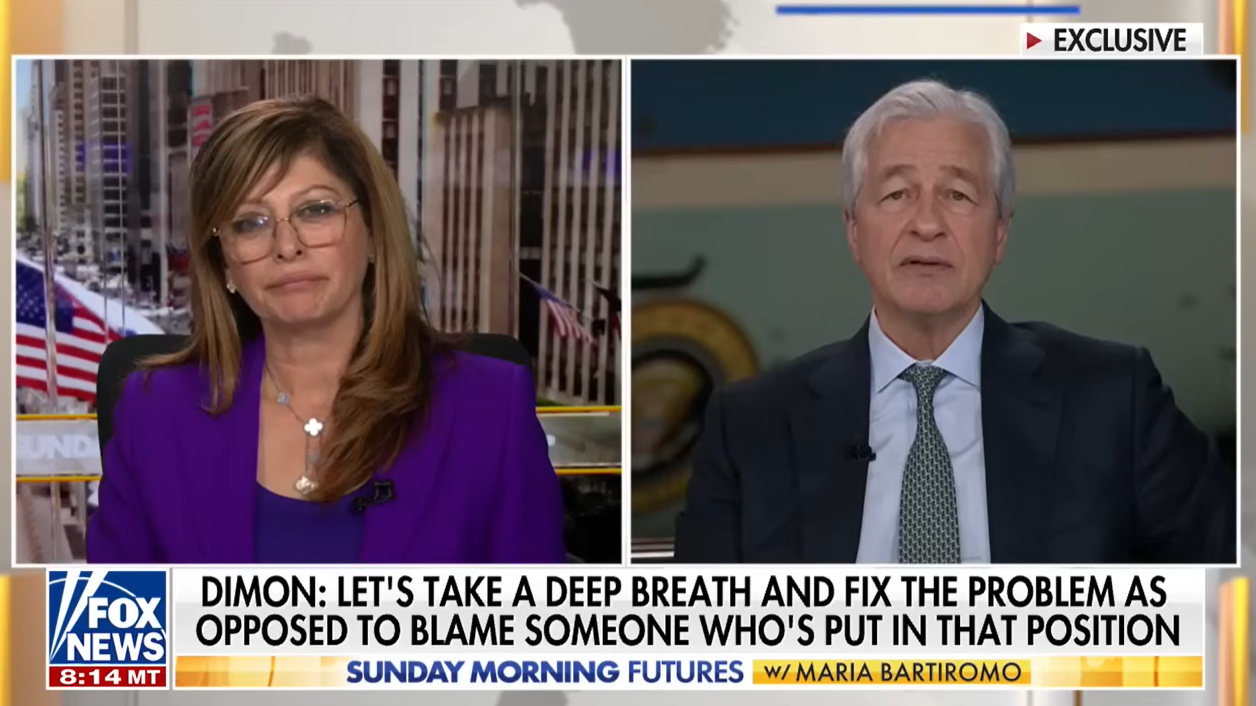

JPMorgan Chase CEO Jamie Dimon said the bank does not terminate customer relationships based on political or religious affiliation and has advocated changes to debanking rules for more than a decade, speaking in a Fox News “Sunday Morning Futures” interview on Sunday.

Dimon stated the bank has ended services for customers from various backgrounds but said political ties are not a factor. He added that he cannot comment on specific accounts.

His comments follow allegations from Devin Nunes, chair of the President’s Intelligence Advisory Board and CEO of Trump Media, who said JPMorgan debanked the company and cited subpoenas of banking records for more than 400 Trump‑linked individuals and organizations by special counsel Jack Smith as part of an investigation.

Jack Mallers, CEO of Bitcoin Lightning Network payments firm Strike, said last month that JPMorgan closed his personal accounts without explanation, prompting renewed concerns about an “Operation Chokepoint 2.0.” Houston Morgan, head of marketing at non-custodial exchange ShapeShift, reported a similar experience in November.

“People have to grow up here, OK, and stop making up things and stuff like that,” Dimon said. “I can’t talk about an individual account. We do not debank people for religious or political affiliations. We do debank them. They have religious or political affiliations. We debank people who are Democrats. We debank people who are Republicans. We have debanked different religious folks. Never was that for that reason.”

Dimon calls for changes to debanking rules

Dimon said he opposes debanking and wants reporting requirements that can lead to account closures revised. “I actually applaud the Trump administration, who’s trying to say that debanking is bad and we should change the rules. Well, damn it, I have been asking to change the rules now for 15 years. So change the rules.”

He added that current practices are “really customer unfriendly,” noting that some customers are debanked due to suspicions, negative media, or other factors.

In August, US President Donald Trump signed an executive order directing banking regulators to investigate debanking claims raised by the crypto sector and conservatives.

Dimon says JPMorgan has proposed steps to limit debanking

Dimon said banks are required to provide information to the government only when subpoenaed and added that JPMorgan has offered recommendations to reduce reporting burdens and instances of debanking. “We don’t give information to the government just because they ask. We’re subpoenaed. We are required by court to give it to the government. And I have been following subpoenas with this administration, the last administration, the administration before that and the one before that. And I don’t agree with a lot of it,” he said.

“The government does a lot of things that can anger banks. So, let’s just take a deep breath and fix the problems, as opposed to, like, blame someone who’s put in that position,” he added.

Dimon also said administrations from both parties have pressured banks. “Democratic and Republican governments have come after us both; let’s not act like this is just one side doing this. This has been going on for a long time. And we should stop militarizing the government that kind of way.”

#Blockchain #Politics #Business #Government #Banks #United States #JPMorgan Chase #Regulation Add reaction

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.