Nasdaq lifts caps on Bitcoin, Ether ETF options after SEC waiver

Nasdaq has submitted a rule change to the United States Securities and Exchange Commission seeking to remove position limits on options tied to spot Bitcoin and Ether exchange-traded funds, aiming to align digital-asset ETF options with the framework used for other commodity-based funds.

The filing, dated Jan. 7 and made effective Wednesday, eliminates the existing 25,000-contract cap on options connected to several Bitcoin (BTC) and Ether (ETH) ETFs listed on Nasdaq, including funds managed by BlackRock, Fidelity, Bitwise, Grayscale, ARK/21Shares and VanEck, according to the document.

The SEC waived its customary 30-day waiting period, allowing the change to take effect immediately, while preserving the authority to suspend the rule within 60 days if it determines that additional evaluation is necessary.

Options grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified date. Exchanges and regulators typically apply position limits on options to curb excessive speculation, mitigate manipulation risks and prevent overly concentrated exposures that could increase volatility or affect market stability.

US SEC notice on rule change removing restrictions on certain crypto assets. Source: US SEC

Nasdaq stated the amendment would permit the exchange to handle digital-asset options in the same way as other options eligible for listing, contending that the change removes disparate treatment without diminishing investor protections.

The SEC has opened a public comment period on the proposal. A final decision is anticipated by late February, unless the rule is stayed for further review.

The submission follows Nasdaq’s approval in late 2025 to list options on single-asset crypto ETFs as commodity-based trusts, which enabled Bitcoin and Ether ETF options to trade on the venue but left position and exercise limits in place.

Nasdaq broadens role in crypto markets

Nasdaq has continued to expand its crypto-related activities, spanning initiatives from tokenized equities and unified crypto indexes to adjustments in derivatives rules for Bitcoin ETFs.

In November, the exchange asked the SEC to increase position limits on options linked to BlackRock’s iShares Bitcoin Trust (IBIT) from 250,000 contracts to 1 million, citing rising demand and asserting that the existing cap constrained hedging and other trading strategies.

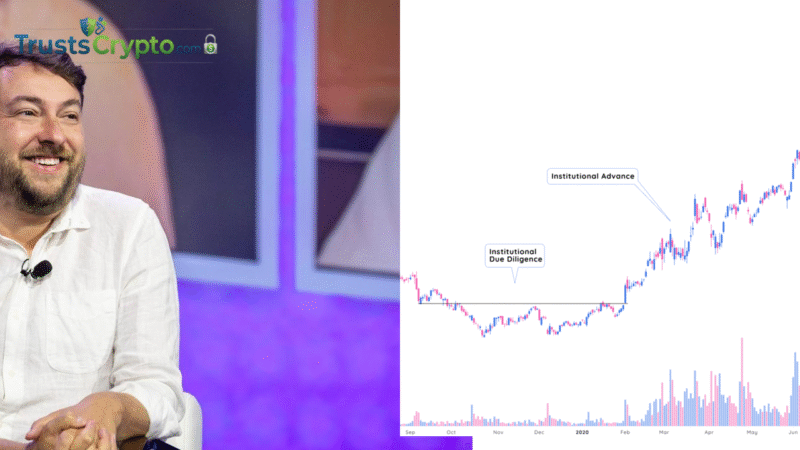

That same month, Matt Savarese, Nasdaq’s head of digital assets strategy, told CNBC the company was prioritizing regulatory approval to offer tokenized versions of its listed equities, and planned to move quickly through the SEC’s review process as public comments and agency feedback are addressed.

Nasdaq’s head of digital assets, Matt Savarese, in a November interview. Source: CNBC

In January, Nasdaq and CME Group said they would align their crypto benchmarks, renaming the Nasdaq Crypto Index as the Nasdaq-CME Crypto Index, a multi-asset gauge tracking major cryptocurrencies including BTC, ETH, XRP (XRP), Solana (SOL), Chainlink (LINK), Cardano (ADA) and Avalanche (AVAX).

Nasdaq operates electronic markets for equities, derivatives and exchange-traded products in the United States and serves as a primary listing venue for technology and growth-focused issuers.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.