Northern Data Sells Bitcoin Mining Arm to Tether Execs’ Firms

Northern Data, which is majority-owned by Tether, has divested its Bitcoin mining subsidiary, Peak Mining, to companies controlled by senior Tether executives, the Financial Times reported on Friday.

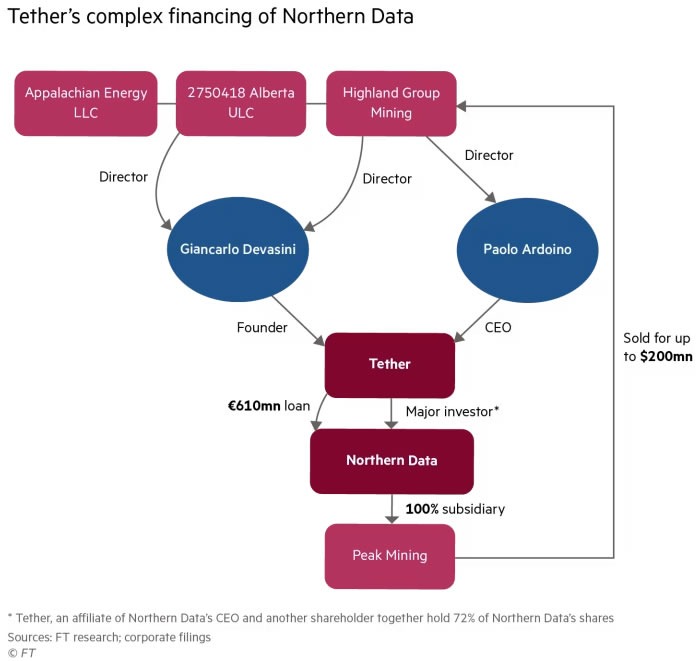

The Peak Mining unit was sold for up to $200 million to Highland Group Mining, Appalachian Energy, and an Alberta-based company operated by Tether co-founder and chair Giancarlo Devasini and CEO Paolo Ardoino, according to the report. Corporate filings cited by the FT indicate that Highland Group’s directors are Devasini and Ardoino, while Devasini is the sole director of the Alberta entity. The operator of Delaware-based Appalachian Energy was not disclosed.

Northern Data first announced the Peak Mining divestment in November without naming the buyers, stating it was not required to do so under German regulations.

The transaction occurred shortly before video platform Rumble — in which Tether holds nearly a 50% stake — agreed to acquire Northern Data.

Complex network of financial ties

The sale marks a second attempt to transfer Peak Mining to a Devasini-controlled company. An earlier deal announced in August with Elektron Energy for $235 million collapsed following whistleblower allegations.

Northern Data is under investigation by European prosecutors for suspected tax fraud, and its offices were searched in September.

Tether has also entered a $100 million advertising agreement with Rumble and plans to purchase $150 million in GPU services from the platform as it expands further into Bitcoin mining.

Northern Data currently has a 610 million euro ($715 million) loan from Tether. As part of the Rumble acquisition, the FT reported that Tether will receive half of the loan balance in Rumble stock, with the remainder to be repaid through a new Tether loan to Rumble secured by Northern Data assets.

Tether diversifies beyond stablecoins

Tether remains the leading stablecoin issuer, holding a 60% market share with $187 billion in USDT in circulation.

Beyond Bitcoin mining, AI, and video platforms, Tether is also evaluating sports investments. On December 12, the company submitted a $1.1 billion bid to acquire Italian soccer club Juventus Football Club, which was rejected by the team’s owners.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.