NYDIG: Tokenized RWAs Offer Modest Gains Now, More Later

Tokenized stocks are unlikely to deliver substantial immediate gains to crypto networks, but benefits could grow as access, interoperability, and on-chain composability improve alongside regulation, according to NYDIG. “The benefits to networks these assets reside on, such as Ethereum, are light at first, but increase as their access and interoperability and composability increase,” NYDIG global head of research Greg Cipolaro wrote in a note on Friday.

Cipolaro said early advantages will come from transaction fees generated by activity in tokenized assets, while the blockchains that host them may see “increasing network effects” as more assets are recorded on-chain.

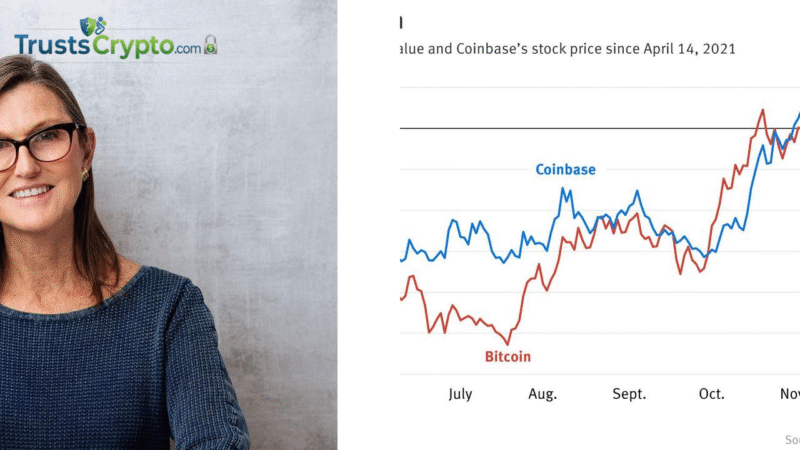

Interest in tokenizing real-world assets (RWAs), including U.S. equities, has accelerated. Major exchanges such as Coinbase and Kraken have indicated plans to introduce tokenized stock services in the United States following launches abroad.

Securities and Exchange Commission chair Paul Atkins said earlier this month that the U.S. financial system could adopt tokenization within a “couple of years,” which Cipolaro said suggests tokenization is set to become a significant trend.

Paul Atkins speaking to Fox Business earlier in December on tokenized US stocks. Source: Fox Business

“In the future, one could see these RWAs being part of DeFi (composability), either as collateral for borrowing, an asset to be lent out, or for trading,” Cipolaro wrote, adding that progress will depend on advancements in technology, infrastructure buildout, and regulatory clarity.

Tokenized assets vary widely

Cipolaro noted that creating tokenized assets that are both composable and interoperable is complex because their “form and function differ greatly,” and they can exist across both public and permissioned networks.

He said the Canton Network, a permissioned blockchain developed by Digital Asset Holdings, is currently the largest platform for tokenized assets, with $380 billion, or “91% of the total ‘represented value’ of all RWAs.”

Ethereum is “by far and away” the most widely used public blockchain for tokenized assets, with $12.1 billion in RWAs deployed, he added.

“But even on an open, permissionless network such as Ethereum, the design of the specific tokenized asset can vary greatly,” Cipolaro said. Because many RWAs are securities, broker-dealers, KYC and investor accreditation, whitelisted wallets, transfer agents, and other traditional finance structures are often required.

Despite these traditional requirements, companies are adopting blockchain for benefits such as near-instant settlement, 24/7 operations, programmatic ownership, transparency, auditability, and more efficient use of collateral.

“In the future, if things become more open and regulations become more favorable, as Chairman Atkins suggests, access to these assets should become more democratized, and thus these RWAs would enjoy expanded reach,” Cipolaro wrote. He added that investors should monitor developments, even if the current economic impact on traditional cryptocurrencies remains limited.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.