RedotPay raises $107M Series B led by Goodwater Capital

Stablecoin payments firm RedotPay raised $107 million in a Series B round led by Goodwater Capital, lifting its total funding in 2025 to $194 million, the company said in a Tuesday press release.

Pantera Capital, Blockchain Capital and Circle Ventures participated in the round, alongside continued backing from existing investors including HSG.

Founded in Hong Kong, RedotPay offers stablecoin-based payment products, including a card for spending digital assets, stablecoin-powered payout rails for cross-border transfers, and services to access and hold stablecoins through multicurrency accounts and a peer-to-peer marketplace.

The company reports more than 6 million registered users in over 100 markets, processing over $10 billion in annualized payment volume and generating more than $150 million in annualized revenue.

RedotPay said the proceeds will be used for acquisitions, obtaining additional licenses, expanding compliance operations, and hiring across engineering and product teams as it enters new markets and broadens its payments offering.

In September, RedotPay raised $47 million in a round that valued the business at more than $1 billion. That financing included participation from Coinbase Ventures and continued support from Galaxy Ventures and Vertex Ventures.

In December, RedotPay partnered with Ripple to launch a crypto-to-naira payout feature that allows users to convert digital assets into Nigerian naira and receive funds directly into local bank accounts.

Stablecoin companies raise funds

Several stablecoin-focused companies secured financing in 2025.

In August, venture investors committed nearly $100 million to stablecoin infrastructure firms. Switzerland-based M0 raised $40 million in a Series B led by Polychain Capital and Ribbit Capital, while U.S. startup Rain secured $58 million to develop tools that help banks issue regulated stablecoins.

In October, stablecoin payments company Coinflow raised $25 million in a Series A round led by Pantera Capital. The company said the funds will support expansion of its cross-border payments infrastructure, which uses stablecoins to settle transactions globally.

In November, CMT Digital closed a $136 million fund to back blockchain startups, allocating a portion to stablecoin companies. The firm said it had already deployed roughly a quarter of the fund, including investments in Coinflow and stablecoin company Codex.

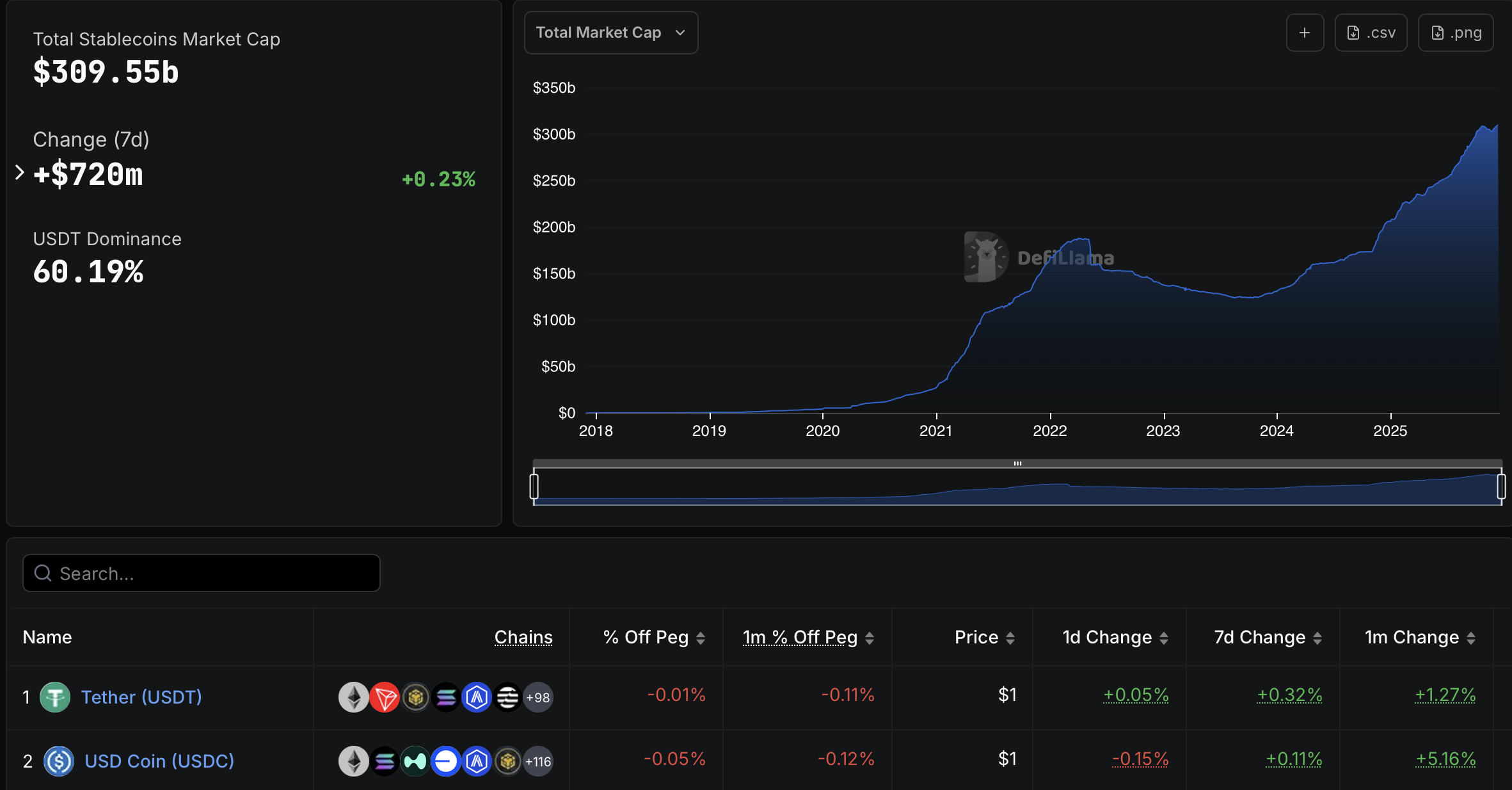

Since the passage of the GENIUS Act in the U.S. on July 18, the stablecoin market has risen by over $50 billion to about $309.55 billion, with more than 60% of the market dominated by Tether’s USDt (USDT), according to DefiLlama data.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.