SEC Crypto Custody Guide, Itaú’s BTC Call, NYDIG on Tokenization

The United States Securities and Exchange Commission released a crypto custody bulletin for retail investors, Brazil’s Itaú Asset Management advised a 1% to 3% Bitcoin allocation for next year, and NYDIG said tokenization’s early benefits to crypto will be limited but could expand with improved interoperability.

SEC issues crypto custody bulletin for investors

The SEC published guidance outlining recommended practices for storing digital assets, covering the trade-offs between offline cold storage and online hot wallets, criteria for selecting a third-party custodian, and measures to safeguard private keys used to authorize transactions and verify onchain identity.

The agency advised investors who opt for third-party custody to understand how a custodian may use client assets, including whether they could be lent out or mixed with other customers’ holdings. The investor-focused bulletin underscores the agency’s broader regulatory shift following the 2024 U.S. presidential election and the appointment of Paul Atkins as SEC chair.

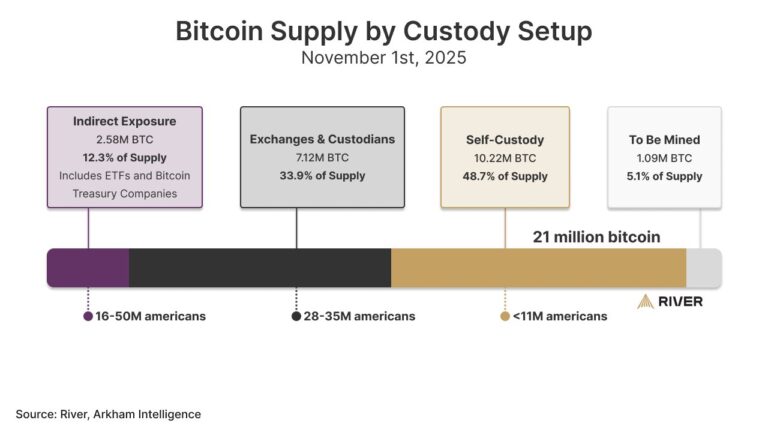

Bitcoin’s supply broken down by the type of custody and exposure. Source: River

Brazil’s largest private bank recommends up to 3% Bitcoin allocation in 2026

Itaú Asset Management, the investment arm of Itaú Unibanco, advised allocating 1% to 3% of portfolios to Bitcoin next year. In a research note, Itaú Asset’s Renato Eid said that geopolitical uncertainty, changing monetary policy, and persistent currency risks support adding Bitcoin (BTC) as a complementary asset.

Eid described Bitcoin as distinct from fixed income, traditional equities, and local markets, citing its own market dynamics and return potential, and noted that its global and decentralized design can serve as a currency hedge.

Bitcoin’s performance this year has been volatile: it started 2025 near $95,000, fell toward $80,000 during the tariff crisis, rallied to a record high of $125,000, and later eased back to around $95,000.

NYDIG: Tokenization’s early impact likely limited, could grow over time

The tokenization of assets such as equities will be “light at first” and not immediately deliver significant benefits to the broader crypto market, NYDIG global head of research Greg Cipolaro said on Friday. He added that early advantages will likely include transaction fees and growing network effects for the blockchains that host tokenized assets, with greater gains possible as regulations evolve, reach expands, and access becomes more democratized.

Cipolaro noted that making tokenized assets interoperable is complex because they differ substantially and may reside on both public and permissioned blockchains, and most still rely on traditional financial frameworks to meet legal requirements.

Interest in tokenizing assets such as U.S. stocks has increased this year, with major exchanges exploring tokenized stock platforms. SEC chair Paul Atkins has said the U.S. financial system could adopt tokenization within “a couple of years.”

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.