Securitize to Launch Compliant Onchain Tokenized Stocks in 2026

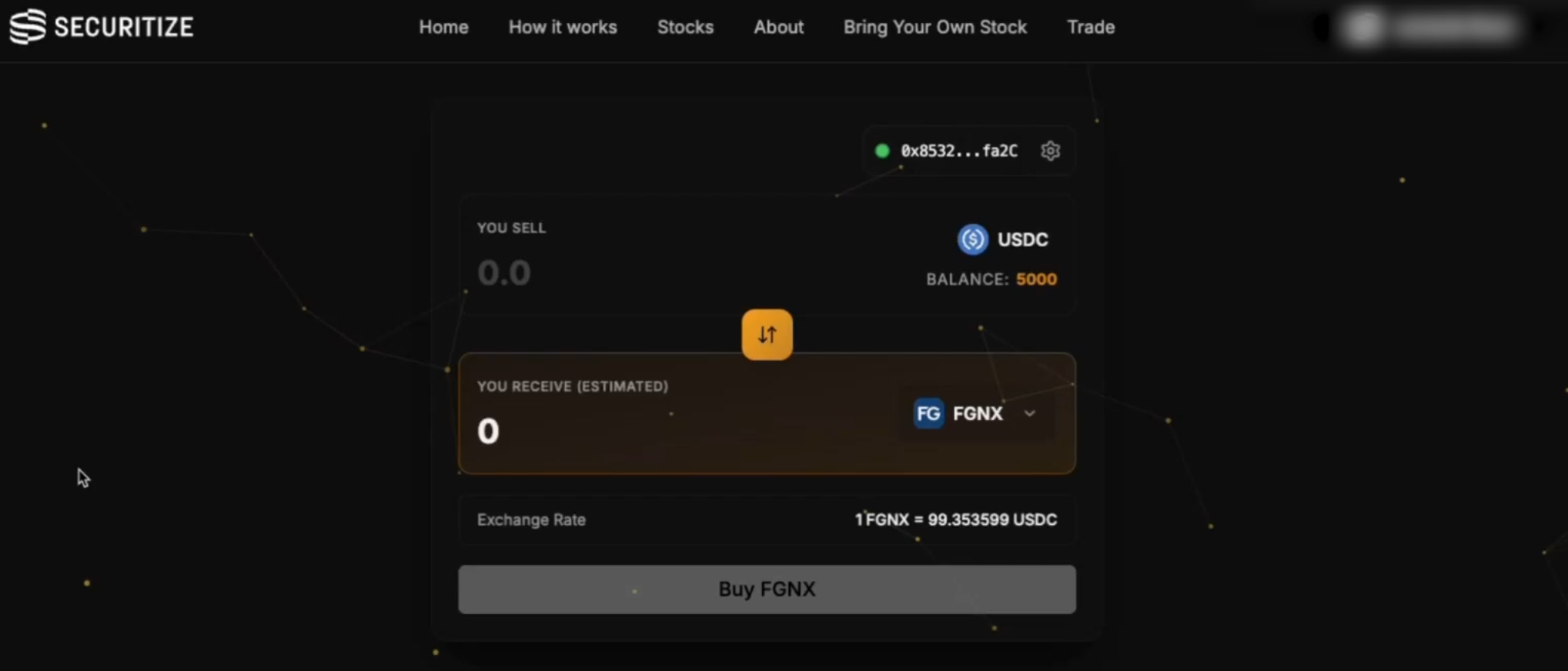

Securitize said on Tuesday it plans to launch a compliant, fully onchain trading service for tokenized public equities representing actual share ownership, with a targeted rollout in the first quarter of 2026. The company said trading will be available around the clock and will use a DeFi-style “swap” interface.

According to the firm, the tokens will be issued directly onchain and recorded on the issuer’s cap table, designed to provide ownership rather than price exposure. Securitize said the structure avoids special-purpose vehicles or offshore arrangements that can introduce counterparty risk or pricing inconsistencies.

The company criticized recent tokenized equity offerings it said provide exposure without conferring ownership and, in some cases, are issued as permissionless assets without Know Your Customer (KYC) or Anti-Money Laundering (AML) controls.

Securitize said buyers and sellers will be able to transact entirely onchain in real time, including outside traditional market hours. It described legacy equity infrastructure as reliant on intermediaries, noting investors typically do not hold shares in their own name and settlement generally takes at least one day. The firm said tokenization at public-market scale must preserve ownership, deliver regulated securities, and uphold investor protections.

The company said its framework centers on compliance, including transfer restrictions that limit movements to approved, whitelisted wallets.

Securitize said it will serve as transfer agent for the shares and described itself as registered with the U.S. Securities and Exchange Commission. Transfer agents maintain shareholder records and process changes in ownership. By combining that role with blockchain-based issuance, the company said the tokens would constitute legally recognized shares rather than proxy claims.

While acknowledging faster settlement as a benefit, Securitize highlighted programmability as the larger opportunity, enabling tokenized securities to interact with smart contracts and other onchain applications. The company said this would allow integration with DeFi platforms while maintaining compliance and user protections, adding that the goal is to upgrade traditional financial infrastructure rather than replace it.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.