Solana price Poised for Major Breakout After Extended Consolidation

Solana, a prominent blockchain platform known for its high throughput and low transaction costs, has been a subject of keen interest among cryptocurrency analysts and investors. After a significant period of consolidation, experts are now pointing towards an imminent and potentially powerful bullish breakout. This anticipated move could propel the Solana price to unprecedented levels, marking a new chapter in its market trajectory.

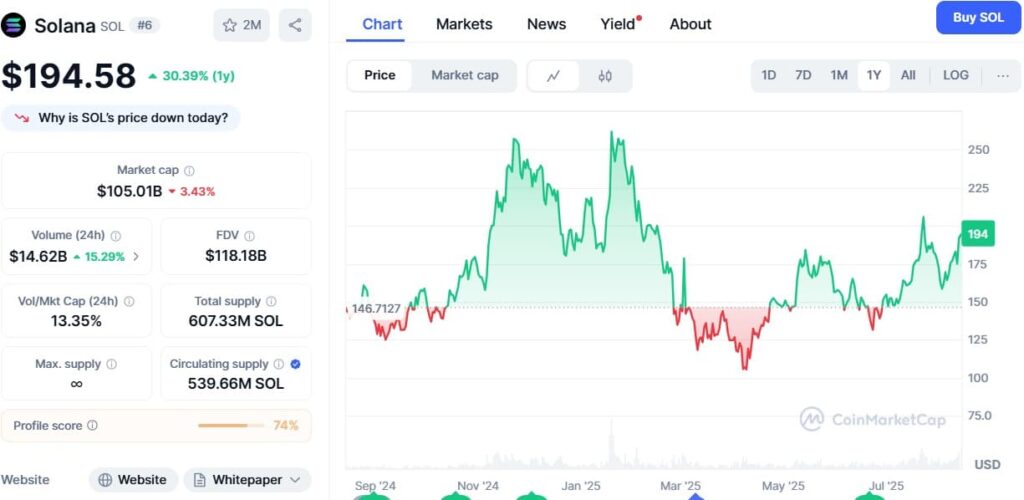

The journey for Solana, like many cryptocurrencies, has been characterized by distinct market cycles. Following a challenging bear market that concluded in December 2022, the asset experienced a swift rebound and entered a crucial accumulation phase at lower price points. This initial recovery set the stage for what was to come.

Historical Precedent: The 280-Day Catalyst for 10x Growth

Understanding Solana’s past market behavior provides valuable context for its current position. A crucial period of consolidation spanned approximately 280 days, from December 2022 to October 2023. During this time, the Solana price remained within a relatively defined range, allowing for sustained accumulation and the building of a strong foundation.

This methodical consolidation phase proved to be an incredibly potent catalyst. Upon its conclusion, Solana embarked on a spectacular rally, surging from approximately $20 to a high of $210, ending in March 2024. This represented an astonishing 10x growth, a testament to the power of a well-defined consolidation period preceding a major market advance. The market effectively re-rated Solana’s value, acknowledging its technological advancements and growing ecosystem.

The Current 525-Day Consolidation: A Signal for Unprecedented Growth?

Fast forward to the present day, and Solana finds itself in another prolonged consolidation phase. However, this current period is significantly longer and, potentially, far more impactful than its predecessor. Since February 2024, the Solana price has been consolidating within a very wide range, accumulating for an impressive 525 days. This extended sideways movement is more than double the length of the previous 280-day consolidation that led to a 10x surge.

Analysts are meticulously observing this prolonged consolidation, drawing parallels and making bold predictions. The theory posits that the longer and wider a consolidation phase, the more energy and momentum are built up for the subsequent breakout. If 280 days could produce 10x growth, the implications for a 525-day consolidation are compelling. The sheer duration suggests an even more powerful, sustained advance once the current range is decisively broken. This period, from late February 2024 through the present day, clearly forms part of this extended sideways channel, and according to expert analysis, it is nearing its conclusion.

Signs of Imminent Breakout: The End of the Current Cycle

The market has recently provided a significant signal: Solana produced a low in April and has been steadily recovering since. This recent low is seen by many as the definitive end of the current consolidation period and, crucially, the beginning of the next bullish wave. This wave is already in motion, building momentum as the Solana price inches closer to critical resistance levels.

The anticipation is palpable: soon, Solana is expected to break its local resistance, which would confirm the bullish reversal and pave the way for a new all-time high. Surpassing a previous all-time high is not merely a psychological milestone; it often triggers a powerful cascade of buying pressure as the asset enters “price discovery” mode, where there’s no historical overhead resistance.

Key Resistance Levels and Ambitious Price Targets

Once Solana establishes a new all-time high, the market will shift its focus to the next set of significant resistance zones. Based on technical analysis, these levels represent areas where selling pressure might increase or where traders could look to take profits.

- First Major Resistance: The immediate zone of importance after a new all-time high is identified around $415, with some analysts noting $420 as a similar point of interest. This level will serve as the first major test for the new bullish trend.

- Second Major Resistance: Beyond the $415-$420 range, the next crucial level to watch is $667, with $620 also being cited as a potential area. Breaking through these resistance points would demonstrate immense strength and conviction from buyers, further solidifying the long-term bullish outlook.

Beyond these initial resistance zones, current market conditions and analytical models support an even more ambitious surge for the Solana price. Projections indicate the potential for SOLUSDT to reach a range of $900 to $1,100. Such a move would represent an extraordinary return from its current consolidation levels and a significant revaluation of the Solana ecosystem.

The Fundamental Underpinnings of Solana’s Potential

While technical analysis provides insights into price movements, the underlying fundamentals of Solana’s blockchain technology and ecosystem are equally crucial for sustaining long-term growth. Solana is designed for scale, offering incredibly fast transaction speeds (tens of thousands of transactions per second) and remarkably low fees, addressing two of the most significant challenges faced by earlier blockchain networks.

- Robust Ecosystem: Solana boasts a rapidly expanding ecosystem of decentralized applications (dApps), including a vibrant DeFi (Decentralized Finance) landscape, thriving NFT marketplaces, and innovative Web3 gaming projects. This growing utility and adoption drive demand for the SOL token, as it is used for transaction fees, staking, and governance within the network.

- Developer Activity: A strong and active developer community is vital for any blockchain. Solana has attracted a significant number of developers, constantly building and deploying new applications, which enhances the network’s value proposition and broadens its appeal.

- Technological Innovation: Solana’s unique consensus mechanism, Proof of History (PoH), combined with Proof of Stake (PoS), allows it to achieve its impressive performance metrics. Continued innovation and improvements to the core protocol further enhance its competitiveness in the blockchain space.

These fundamental strengths provide a solid foundation for the technical breakouts predicted by analysts, reinforcing the idea that the potential surge in Solana price is not merely speculative but backed by tangible utility and adoption.

Stay informed, read the latest news right now!

Conclusion: A New Era for Solana?

Solana has endured a prolonged period of consolidation, a phase that, historically, has preceded significant upward movements. The current 525-day accumulation period, significantly longer than its predecessor which led to a 10x growth, suggests that the next advance could be even more substantial. With the recent low in April signaling the end of this consolidation and the commencement of a new bullish wave, the market is on the cusp of a major shift.

Analysts are confidently predicting that Solana will soon break its local resistance, establish a new all-time high, and then target resistance zones at $415 (or $420) and $667 (or $620). The most optimistic projections see the Solana price potentially soaring into the $900-$1,100 range. As the network continues to expand its ecosystem and prove its technological capabilities, all eyes are on Solana for what could be its most significant rally yet.