Spot Bitcoin ETFs see $167M; Goldman trims BTC, adds XRP, Solana

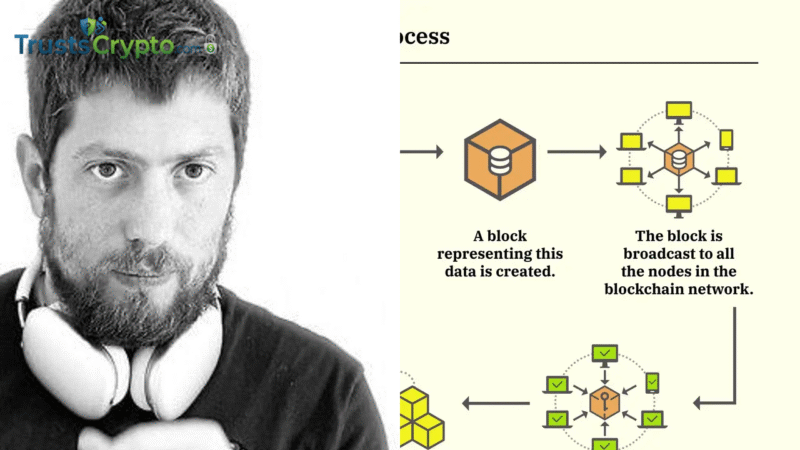

US spot Bitcoin exchange-traded funds (ETFs) extended their inflow streak to three consecutive sessions, with Tuesday’s $166.6 million intake lifting week-to-date inflows to $311.6 million, according to SoSoValue. The gains nearly offset last week’s $318 million in net outflows.

Last week’s redemptions marked a third straight week of losses, with cumulative outflows over the period exceeding $3 billion.

Weekly flows in US spot Bitcoin ETFs in 2026. Source: SoSoValue

ETF momentum improved even as Bitcoin declined about 13% over the past seven days and briefly fell below $68,000 on Tuesday, per CoinGecko. Earlier this week, analysts tracking crypto exchange-traded products noted signs of easing selling pressure.

Goldman trims Bitcoin ETF exposure, adds XRP and Solana ETFs

Goldman Sachs reduced its Bitcoin ETF exposure in the fourth quarter of 2025, a Form 13F filing with the US Securities and Exchange Commission shows.

The bank cut holdings in BlackRock’s iShares Bitcoin Trust ETF (IBIT) by 39%, from nearly 70 million shares in Q3 to 40.6 million in Q4, valued at approximately $2 billion.

Goldman Sachs’ holdings of iShares Bitcoin Trust ETF (IBIT) in Q4 2025. Source: SEC

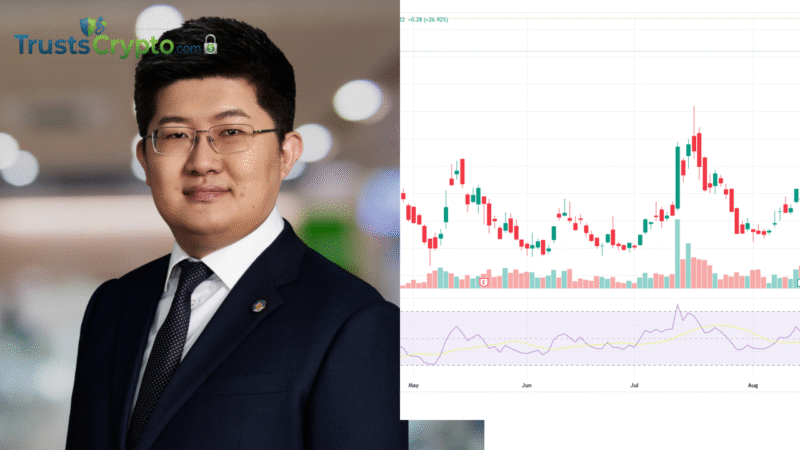

Goldman also trimmed positions in other Bitcoin-focused funds and companies, including Fidelity Wise Origin Bitcoin (FBTC) and Bitcoin Depot, and reduced its Ether (ETH) ETF exposure.

At the same time, the bank initiated positions in XRP (XRP) and Solana (SOL) ETFs, acquiring 6.95 million shares of XRP ETFs worth $152 million and 8.24 million shares of Solana ETFs valued at $104 million.

According to SoSoValue, spot altcoin ETFs saw moderate inflows on Tuesday, with Ether funds adding about $14 million, while XRP and Solana ETFs gained $3.3 million and $8.4 million, respectively.

On Thursday, Eric Balchunas, senior ETF analyst at Bloomberg, said most Bitcoin ETF investors maintained their positions during the downturn, estimating that roughly 6% of total assets exited the funds amid the price drop. He added that although BlackRock’s IBIT assets declined to $60 billion from a $100 billion peak, the fund could remain around this level for an extended period while retaining the record as the all-time-fastest ETF to reach $60 billion.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.