Tokenized commodities surpass $6B as gold rally drives growth

The tokenized commodities market has climbed 53% in under six weeks to more than $6.1 billion, emerging as the fastest-expanding segment within real-world asset tokenization as additional gold exposure moves onchain, according to Token Terminal.

Market capitalization stood slightly above $4 billion at the start of the year, indicating that roughly $2 billion has been added since Jan. 1, Token Terminal data shows.

Gold-linked products account for the majority of the sector. Tether’s gold-backed Tether Gold (XAUt) recorded the largest increase, with market value up 51.6% over the last month to $3.6 billion. Paxos’ PAX Gold (PAXG) rose 33.2% to $2.3 billion during the same period.

On a year-over-year basis, tokenized commodities are up 360%. Since the start of 2026, their growth has outpaced tokenized stocks and tokenized funds, which increased 42% and 3.6%, respectively. The tokenized commodities market now represents just over one-third of the $17.2 billion tokenized funds market and is substantially larger than tokenized stocks, valued at $538 million.

Tether extended its tokenized commodities strategy by taking a $150 million stake in precious-metals platform Gold.com. The company said XAUt will be integrated into Gold.com and that it is assessing ways to enable purchases of physical gold using its USDt (USDT) stablecoin.

Gold’s advance continues as Bitcoin holds below $70,000

The acceleration in tokenized gold aligns with a broader rally in the metal’s spot price, which has climbed more than 80% over the past year to a record high of $5,600 on Jan. 29. After a brief retreat to $4,700 earlier this month, gold has recovered to about $5,050 at the time of writing.

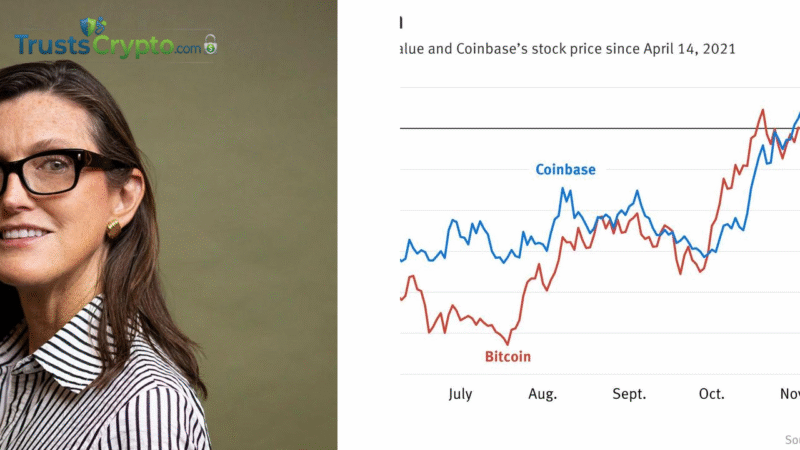

By contrast, Bitcoin (BTC) and the broader crypto market have lagged since Oct. 10, when a market sell-off triggered $19 billion in liquidations.

Bitcoin declined 52.4% from its early October peak of $126,080 to roughly $60,000 on Friday and has since rebounded to $69,050, according to CoinGecko.

Some market observers, including Strike CEO Jack Mallers, have suggested Bitcoin continues to trade like a software equity despite “hard money” attributes. Crypto asset manager Grayscale said the long-standing “digital gold” narrative has been challenged, noting recent price behaviour has resembled that of a high-risk growth asset rather than a traditional safe haven.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.