Trump Raises Tariffs to 15%; Bitcoin ETFs Log 5 Weeks Outflows

Here are the key developments in crypto today: The United States raised its global tariff rate to 15%, U.S. spot Bitcoin ETFs registered a fifth consecutive week of net outflows, and Bitcoin traded largely unchanged despite renewed trade uncertainty following a U.S. Supreme Court decision on tariffs.

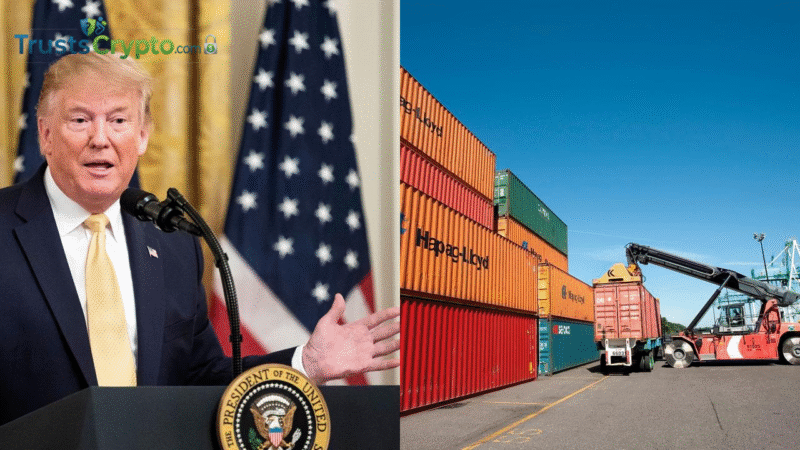

US President Donald Trump raises global tariff rate to 15%

United States President Donald Trump announced on Friday a 5% increase to the previously stated global tariff rate, lifting it to 15%. The new levy will be applied on top of existing, legally valid tariffs.

The announcement came after the Supreme Court ruled that Trump lacked authority to impose tariffs under the International Emergency Economic Powers Act (IEEPA). Trump said on Saturday:

“As President of the United States of America, I will be, effective immediately, raising the 10% worldwide tariff on countries, many of which have been ‘ripping’ the US off for decades, without retribution, until I came along, to the fully allowed, and legally tested, 15% level.”

Source: Donald Trump

Risk assets, including cryptocurrencies, often decline when new tariffs are introduced. However, digital asset markets were largely stable and showed minimal reaction to the latest announcement.

Spot Bitcoin ETFs record five weeks of net withdrawals, totaling $3.8B

U.S. spot Bitcoin exchange-traded funds (ETFs) posted five straight weeks of net outflows, with approximately $3.8 billion withdrawn over the period.

For the most recent week, the products saw around $315.9 million in net outflows, according to SoSoValue. The largest weekly withdrawal during this five-week span occurred in the week ending Jan. 30, when spot Bitcoin (BTC) ETFs recorded roughly $1.49 billion in net redemptions.

Individual sessions varied. On Friday, the funds took in about $88 million, but those inflows were offset by larger redemption days earlier in the week. Notable outflows included more than $410 million on Feb. 12, with additional negative sessions from Feb. 17 through Feb. 19, resulting in a negative weekly total.

Spot Bitcoin ETFs have posted outflows for five consecutive weeks. Source: SoSoValue

Recent withdrawals appear to reflect institutional portfolio repositioning rather than waning long-term interest, said Vincent Liu, chief investment officer at Kronos Research, citing de-risking amid rising geopolitical tensions and broader macro uncertainty.

Bitcoin price steady after Supreme Court ruling

Bitcoin traded in a narrow range on Friday around $68,000 after the U.S. Supreme Court ruled that President Trump’s tariffs were unconstitutional.

In a 6–3 decision, the court determined that key elements of the tariff program were unlawful, concluding that the IEEPA did not authorize the executive branch to impose broad import duties. The decision reaffirmed Congress’s authority over tariff policy and could enable claims for refunds on duties collected since 2025, potentially totaling billions of dollars.

Despite discussion of up to $150 billion in potential refunds, Bitcoin’s price action was little changed, with traders focusing on broader U.S. inflation data and reduced expectations for rate cuts. Risk assets showed caution, with crypto markets reacting more to macro sentiment than to the legal shift in trade policy.

This report aims to provide accurate and timely information for informational purposes only. Readers should independently verify details before making financial decisions.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.