US OKs crypto bank; China bans yuan stablecoins; 400K ETH sold

Here are the key developments in crypto today. The United States approved a national bank charter for Erebor Bank ; China prohibited the unapproved issuance of yuan-pegged stablecoins and tokenized real-world assets; and Trend Research moved more than 400,000 ETH as it reduced leverage amid market declines.

News

OCC grants national bank charter to Erebor Bank, first new U.S. bank approval of Trump’s second term: WSJ

The Office of the Comptroller of the Currency (OCC) confirmed on Friday that it approved a charter for Erebor Bank, enabling the institution to operate nationwide, the Wall Street Journal reported, citing people familiar with the matter. It marks the first approval of a newly formed national bank during President Donald Trump’s second term.

The lender launches with approximately $635 million in capital and plans to serve startups, venture-backed companies and high-net-worth clients, a segment that faced constraints after the 2023 collapse of Silicon Valley Bank.

Erebor is supported by investors including Andreessen Horowitz, Founders Fund, Lux Capital, 8VC and Elad Gil. The firm was founded by Oculus co-creator Palmer Luckey, who will join the board but will not oversee day-to-day operations.

China restricts unapproved yuan-linked stablecoins and tokenized RWAs

The People’s Bank of China, together with seven additional regulators, issued a joint notice barring the unauthorized issuance of yuan-pegged stablecoins and tokenized real-world assets (RWAs) by both domestic and foreign entities.

The statement specifies that no organization or individual, whether inside or outside China, may create or issue Renminbi-linked stablecoins without explicit regulatory approval. The prohibition includes offshore yuan-referenced stablecoins, closing a perceived gap for crypto activity near China’s borders.

Authorities also incorporated RWA tokenization into the existing risk framework, stating that converting real assets into tradable tokens without authorization may constitute illegal financial activity. Regulators said the policy supports efforts to keep speculative digital assets outside the formal financial system while advancing the state-backed digital yuan (e-CNY).

China’s central bank digital currency structure. Source: Cointelegraph

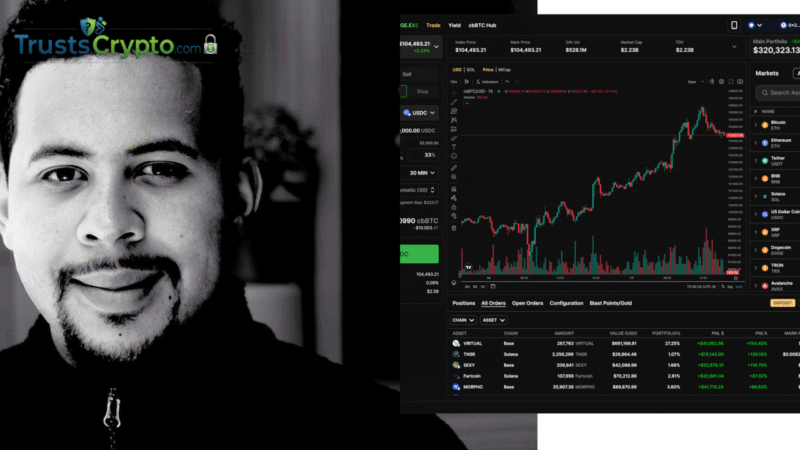

Trend Research offloads over 400K ETH as liquidation pressures mount

Ethereum-focused vehicle Trend Research continued to trim its Ether exposure as the recent market sell-off prompted asset sales to repay loans. The firm held about 651,170 Ether (ETH) in Aave Ethereum wrapped Ether (AETHWETH) on Sunday; that balance fell by 404,090 to roughly 247,080 by Friday.

Since the start of the month, Trend Research transferred 411,075 ETH to cryptocurrency exchange Binance, according to blockchain analytics platform Arkham.

The transfers coincided with a nearly 30% weekly decline in ETH, which fell to $1,748 on Friday before trading at $1,967 at the time of writing, according to CoinMarketCap .

Trend Research has been linked to Jack Yi, founder of Hong Kong-based crypto venture firm Liquid Capital. Yi built the company’s ETH position by purchasing on exchanges, using ETH as collateral on Aave to borrow stablecoins, and deploying those funds to buy additional ETH.

Trend Research, WETH token balance history, one-week chart. Source: Arkham

Disclaimer: This article is for informational purposes only and is based on publicly available data and third-party reports. Readers should verify information independently.

Stay informed, read the latest news right now!

Disclaimer

The content on TrustsCrypto.com is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, always do your own research before making decisions.

Some content may be assisted by AI and reviewed by our editorial team, but accuracy is not guaranteed. TrustsCrypto.com is not responsible for any losses resulting from the use of information provided.